As African retail investors, it’s crucial to be in the know about key global financial occurrences and their impact on our local markets. That’s why we are diving deep into dropping manufacturing PMIs, commodity supply issues, currency oscillations, and shifts in US equities. But don’t worry, we won’t leave you hanging. We’ll also shed light on exciting investment opportunities in Africa, with a special focus on Nigeria’s private equity space, attractive dollar investments, and the promising Nigerian sovereign wealth fund. So, grab your financial compass and let’s navigate together!

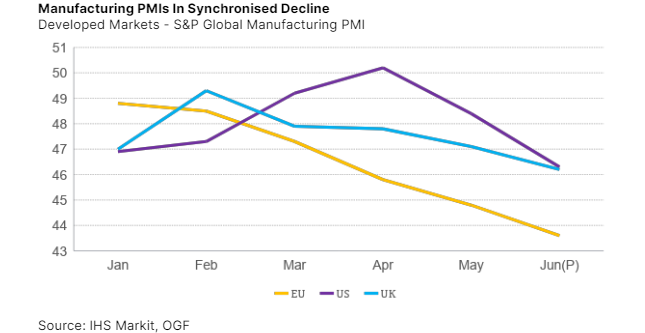

Global Slowdown: DM Manufacturing PMIs Take a Tumble

Preliminary composite PMIs for June reveal growth in the services sector, but there’s a significant slump in manufacturing across the US, UK, and EU. This global slowdown raises concerns about overall growth, which could add depreciation pressure on African currencies like the Nigerian naira and South African rand. As global growth slows down, it impacts the demand for resources, thus affecting African nations that heavily rely on resource exports. Stay informed and be prepared for the twists and turns ahead.

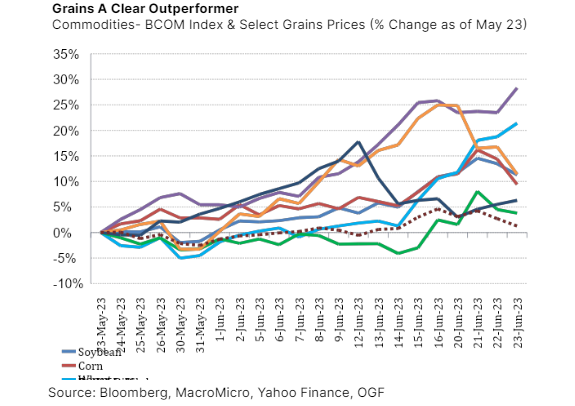

Commodity Market: Supply Shortages Fuel Grain Prices

Grain prices are skyrocketing due to supply constraints caused by weather disruptions and geopolitical risks like the Russia-Ukraine war. As these supply constraints persist, the price hikes are likely to stick around. Retail investors, pay attention! There might be potential opportunities within the grain market. But remember to look out for the strengthening dollar and its impact on commodity demand. Stay alert and spot the golden opportunities.

Currency Markets: Dollar Reign and Local Dynamics

The US dollar continues to rule the currency markets, affecting emerging and frontier market currencies such as the Turkish Lira, Zambian Kwacha, and Nigerian Naira. But here’s the catch: local factors play a significant role in currency fluctuations too. African retail investors, especially those in the West African diaspora, need to closely monitor the monetary policies of these countries and their strategies to combat inflation. It’s a balancing act between global trends and local dynamics.

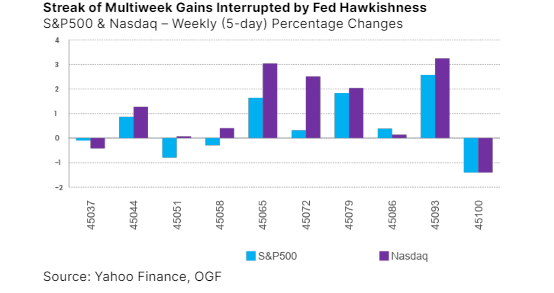

US Equities: A Temporary Hiccup Amidst Rate Hike Expectations

Fed Chair Powell’s testimony suggesting two more interest rate hikes has put a temporary halt on the consistent gains of the Nasdaq and S&P 500. But fear not!, Bullish sentiment surrounding artificial intelligence (AI) and future rate hike expectations indicate a potential bounce back. African retail investors must keep a keen eye on these developments. Who knows? The AI sector might be where the real magic happens.

Implications for African Retail Investors

Currency depreciation can significantly impact the savings and investments of African retail investors, including those in the African diaspora. Safeguarding your wealth through dollar-denominated assets or inflation-resistant investments becomes crucial. Currency devaluation impacts investment returns, making it essential to explore diversification options. And remember persistent currency depreciation can hinder economic growth by increasing import costs and affecting investment returns. Stay nimble, and explore your options!

Investment Opportunities in Nigeria

Investments in real estate and inflation-linked bonds can provide a hedge against inflation and currency depreciation. Exploring opportunities offered by private equity firms in Nigeria and the Nigerian sovereign wealth fund can tap into the growth potential of the Nigerian economy.

Our Takeaway

African retail investors, including those from the West African and global African diaspora, need to grasp global financial trends and economic indicators. These include declining manufacturing PMIs, supply chain and commodity disruptions, currency variances, and US equity shifts. This understanding facilitates sound financial decisions. Maximizing profitable opportunities like Nigerian private equity, dollar investments, and the Nigerian sovereign wealth fund can empower these investors to confidently navigate the changing financial environment.

Don’t miss out on the latest updates and insights that can help shape your investment decisions. Subscribe to our newsletter today.

Read our previous Weekly Market Note.