African investors, at home and in the diaspora, are looking for global investment opportunities that can boost their wealth. This week, they can learn from US earnings reports and inflation data, which have implications for different sectors and markets. Here are some key points and tips for African investors to consider.

US Earnings Season

Some companies, such as Helen of Troy, WD-40 Company, and Price Smart, will release their earnings reports this week. These reports can give African investors early clues about how specific sectors are performing. Although these companies may not affect the S&P500 much, they can influence their sub-indices. Investors can use this information to spot potential investment opportunities and sectors to watch in the global market.

Transportation Sector Rebound

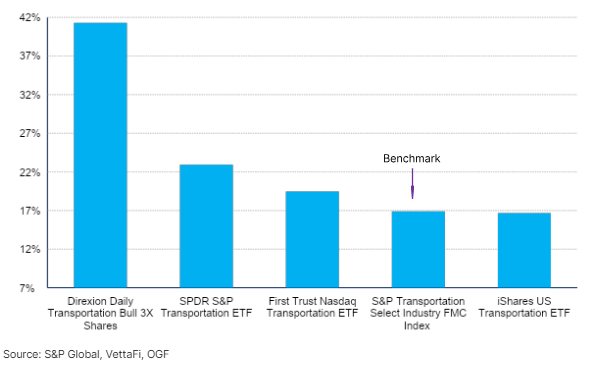

Delta Airlines’ earnings report is especially important for African investors. It represents the passenger airline industry, which has been recovering from the pandemic. The increase in domestic and international travel has boosted the industry and the US transportation ETFs. African investors who want to diversify their portfolios can look into ETFs such as Direxion Daily Transportation Bull 3X Shares, iShares US Transportation ETF, and SPDR S&P Transportation ETF. These ETFs have shown strength, driven by the improving fundamentals in the passenger airline sector. The transportation sector rebound offers a chance for Africans to join the global recovery and diversify their portfolios.

US Banking Sector Insights

Earnings reports from major banks like JP Morgan Chase, Wells Fargo, and Citigroup can reveal the health of the US banking sector. African investors can follow these reports to evaluate the sector’s performance and potential investment opportunities. Larger banks may benefit from safe deposit inflows, so Africans can analyze the banking sector for prospects that suit their financial goals. Understanding the US banking sector helps African investors make strategic investment decisions in a global context.

Earnings Forecast and Inflation Trends

African investors also need to consider the possible impact of earnings forecasts and inflation readings. While earnings growth is expected to drop in Q2 2023, it’s important to look at the broader market trends and specific sectors relevant to African investment objectives. Moreover, inflation data, including CPI and PPI, can indicate the direction of US monetary policy, which can affect global investment opportunities for African investors. By staying informed and weighing these factors, investors can make smart decisions and position themselves for optimal investment outcomes.

Global Investment Opportunities for African Investors

Investors in Africa and the diaspora can tap into global investment pathways beyond their local markets. Vigilantly observing global economic events, earnings reports, and inflation readings can help identify potential investment sectors like transportation and banking. A diverse investment portfolio across various asset classes and geographic regions can mitigate risk and optimize investment outcomes, thereby bolstering African wealth.

How to Chart Successful Investment Paths

As African investors navigate the international financial landscape, understanding US earnings reports and inflation trends can provide valuable insights into potential investment opportunities. By actively monitoring these global events, African investors can make informed decisions, capitalizing on global investment opportunities, thereby enhancing wealth.

Our Commitment

At the Opportunity Global Fund, we’re committed to creating global opportunities for Africans and the diaspora. That’s why we’ve launched “A Celebration of African Prosperity” global roadshow. At this event, we’ll share research findings, answer your queries, and share proven solutions.

Don’t miss this chance to expand your horizons.

Register for our global event today!

For More Read From US Equities to Bitcoin: Navigating the Best Investment Opportunities for Africans in 2023