The market served up a perfect case study in catalyst diversity this week, with winners emerging from laboratory breakthroughs, AI infrastructure demand, and strategic pivots.

While growth stocks stumbled on guidance concerns and IPO darlings faced reality checks, companies with concrete catalysts, from clinical trial victories to cloud transformation milestones, captured institutional attention. The message was clear. In an environment where forward-looking uncertainty dominates headlines, tangible progress commands premium valuations.

At Opportunik, we don’t just track price movements, we translate them into wealth strategy. Here’s what moved, why it happened, and what globally minded African investors should be positioning for:

Top Movers: Winners and Losers

Top 5 Gainers

| Ticker | Company | Weekly Change |

| UTHR | United Therapeutics | +31.42% |

| CLS | Celestica | +24.61% |

| CIEN | Ciena | +24.18% |

| GWRE | Guidewire Software | +20.13% |

| W | Wayfair | +20.12% |

United Therapeutics (UTHR): Here’s the week’s defining story. The company’s TETON-2 trial for idiopathic pulmonary fibrosis hit its primary endpoint, instantly unlocking a multibillion-dollar market opportunity. This wasn’t about incremental progress, it was a binary catalyst that fundamentally altered the investment thesis. After months of volatility including a 25% single-day drop in August, one positive trial result erased all previous concerns and sent analysts scrambling to raise price targets.

Celestica (CLS): The momentum story of 2025 continues. Up 139% in six months, Celestica’s sustained rally reflects its strategic positioning in AI infrastructure. While no single catalyst drove this week’s gains, the company’s 52.6% year-over-year operating cash flow growth and raised guidance to $400 million free cash flow continue powering institutional interest.

Ciena (CIEN): Classic “beat and raise” execution. Adjusted EPS of $0.67 crushed the $0.52 consensus by 29%, while revenue hit $1.22 billion against $1.17 billion expected. The real catalyst? Management’s preliminary 2026 outlook projecting 17% revenue growth and accelerated margin expansion, concrete evidence that AI infrastructure demand translates to sustainable hardware profits.

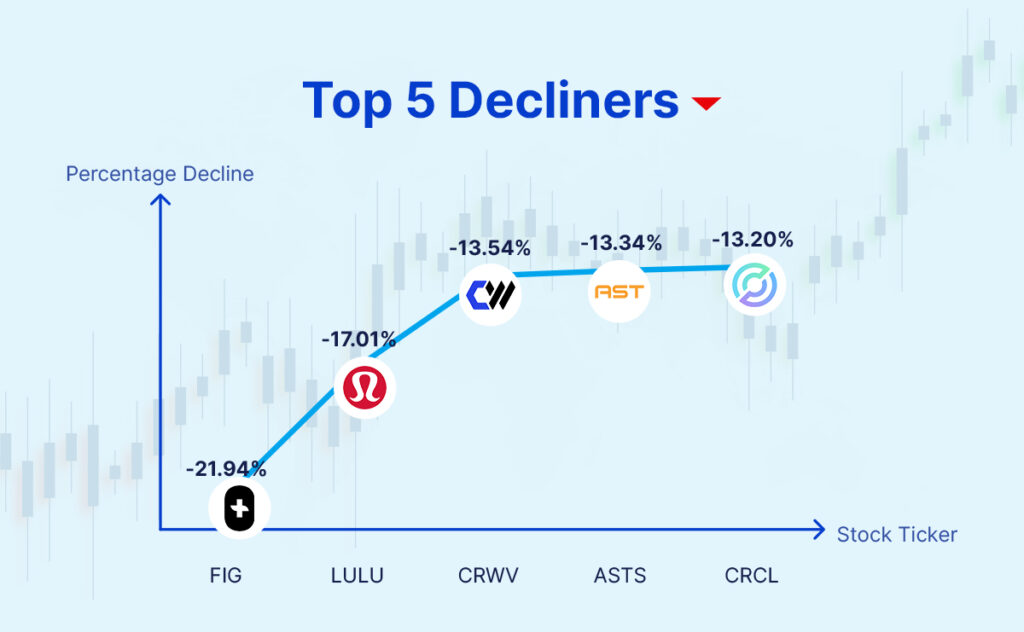

Top 5 Decliners

| Ticker | Company | Weekly Change |

| FIG | Fortress Investment Group | -21.94% |

| LULU | Lululemon | -17.01% |

| CRWV | CoreWeave | -13.54% |

| ASTS | AST SpaceMobile | -13.34% |

| CRCL | Circle Internet Group | -13.20% |

Lululemon (LULU): A textbook lesson in how guidance trumps earnings. Despite beating EPS estimates ($3.10 vs. $2.53), the athletic apparel giant crashed on flat U.S. sales and lowered full-year revenue guidance. The market’s message was clear: premium brands can’t afford to lose momentum in their core markets, regardless of quarterly beats.

CoreWeave (CRWV): The IPO reality check continues. Despite booming fundamentals, revenue up 375% and a $30 billion backlog, the stock has lost nearly half its value from recent highs. This is a valuation reset, not business failure, but it demonstrates how quickly post-IPO euphoria can evaporate when institutional money demands sustainable metrics.

AST SpaceMobile (ASTS): Pre-revenue companies face unforgiving math. Revenue of just $1.15 million missed expectations by 79%, while EPS of -$0.41 doubled the expected loss. Even positive operational news like successful satellite assembly couldn’t overcome the fundamental question: when does burning cash become generating cash?

Equities to Watch

Earnings That Matter

- PL: Planet Labs reporting Monday before open—satellite imagery demand signal

- ANET: Arista’s “2.0 strategy” and 24% expected earnings growth

- MU: Micron’s AI memory positioning amid DRAM recovery

- CRM: Salesforce momentum check after recent guidance concerns

Thematic Plays

- TSCO: Tractor Supply’s 44% dividend payout ratio appeals to income seekers

- TROW: T. Rowe Price surged on $1 billion Goldman partnership

- WSM: Williams-Sonoma riding rate cut anticipation

- AMZN: Project Kuiper’s JetBlue partnership positions against Starlink

Commodities to Watch

Gold: Rally to near all-time highs with 99.4% probability of September 17 Fed cut. Global ETFs saw $5.5 billion inflows in August as institutional money seeks inflation protection.

Silver: Breaking 14-year highs above $40, benefiting from both monetary policy expectations and industrial demand fundamentals.

Brent Crude: Bearish outlook as EIA forecasts decline from $71 to $58 in Q4 2025, driven by ample OPEC+ supply and continued Russian oil flows.

Natural Gas: Rising for second consecutive week after 11-month lows. EIA projects Henry Hub climbing from $3.20 to $3.90 in Q4 on LNG export demand.

Wheat: Multi-year lows from oversupply large harvests in Russia, Ukraine, and expected above-average Australian crop creating fundamental headwinds.

FX Pairs to Watch

EUR: Historically bullish September (+0.63% average over 50 years) supported by stronger Eurozone data and new EU-U.S. trade deal reducing policy uncertainty.

USD: Broad-based weakness as 99.4% Fed cut probability sends Dollar Index lower. Weak labor data intensified rate cut expectations.

GBP: Underperforming on persistent inflation and sluggish growth. September historically second-worst month (-0.37% average since 1971).

JPY: Movement primarily driven by USD trends rather than BoJ policy. September modestly bearish for USD/JPY (-0.17% average).

AUD: Modest outperformance against USD supported by improving domestic data and global “soft-landing” narrative.

Digital Assets to Watch

Bitcoin (BTC): Consolidating near $110,000 psychological level after brief dip below $107,000. Institutional support continues with Metaplanet adding 1,009 BTC. Global M2 liquidity at all-time highs historically correlates with Bitcoin strength.

Ethereum (ETH): The institutional favorite continues. After 200% rally to near $4,950 all-time high, Ether spot ETFs saw 44% increase in net inflows during August while corporate treasuries add ETH to balance sheets.

Solana (SOL): Most bullish technical setup among majors. “Firedancer” and “Alpenglow” upgrades targeting improved speed and reduced transaction delays support infrastructure narrative.

Chainlink (LINK): Critical infrastructure play. Oracle network essential for DeFi and real-world asset tokenization. Cross-Chain Interoperability Protocol driving adoption across traditional and decentralized systems.

ETFs to Watch

- GDXY: YieldMax Gold Miners topped August performance on gold rally and Fed cut expectations

Small/Mid-Cap Value

- RZV: Invesco SmallCap 600 Pure Value returned 11.64% in August

- AVSC: Avantis Small Cap continues rotation theme

- XMVM: Five-star Morningstar-rated mid-cap value with momentum

- ISMD: Inspire Small/Mid Cap beat category average with 9.20% August return

Opportunik Insights

Three Key Themes:

- Biotech – Clinical trial results creating binary wealth events (UTHR breakthrough)

- Infrastructure – AI hardware demand translating to sustainable profits (Celestica, Ciena dominance)

- Guidance – Forward outlook mattering more than backward performance (Lululemon’s fall despite earnings beat)

This week proved that in markets obsessed with future potential, a single clinical trial can matter more than quarters of financial performance. While traditional metrics drove some wins, Ciena’s hardware excellence, Celestica’s AI positioning, the biggest mover succeeded on pure binary science.

The lesson for African investors building global wealth? Diversification across catalyst types remains essential. Whether you’re accessing biotech through international brokers or positioning in AI infrastructure through local platforms, understanding different risk-reward profiles creates asymmetric opportunities.

What This Means for African Investors

Current market dynamics favor patient capital with diversified catalyst exposure. Binary events like clinical trials offer explosive upside but require portfolio sizing discipline. Meanwhile, infrastructure plays provide steadier exposure to secular AI growth trends.

Fed policy pivot creates multiple tailwinds, dollar weakness improves emerging market access costs while rate cuts support growth assets. For African investors with global mandates, currency arbitrage opportunities persist alongside fundamental value discovery.

Geographic arbitrage advantages continue when local markets lag global narrative recognition. The same AI infrastructure driving Celestica and Ciena creates opportunities across supply chains and geographies.

Diversify Your Portfolio with Alternative Assets

Looking beyond public markets? Speak to an Opportunik Advisor to structure your alternative investment portfolio and position for the next phase of global wealth creation.