Nuclear energy just became the hottest trade on Wall Street, and it’s not because investors suddenly discovered physics. This week proved that when governments fast-track anything involving AI infrastructure, the market pays attention. While everyone was debating Fed policy nuances, nuclear reactor companies were quietly building the power grid for our AI-driven future.

At Opportunik, we don’t just track price movements, we translate them into wealth strategies. Here’s what moved, why it happened, and what globally minded African investors should be positioning for:

Top Movers: Winners and Losers

Top 5 Gainers

| Ticker | Company | Weekly Change |

| OKLO | Oklo | +63.50% |

| FIGR | Figure Technology Solutions | +38.34% |

| BLSH | Bullish | +33.45% |

| SMR | NuScale Power | +28.70% |

| IONQ | IonQ | +26.61% |

Oklo (OKLO): The nuclear reactor developer hit a new all-time high after the U.K. and U.S. governments announced they’re fast-tracking new nuclear facilities. When AI data centers need clean baseload power, nuclear suddenly looks like the only viable solution at scale.

Figure Technology Solutions (FIGR): Priced its IPO at $25 per share, raising $787 million by combining AI and blockchain for credit and digital asset marketplaces. Sometimes timing your public debut with crypto sector momentum is everything.

Bullish (BLSH): The digital asset platform posted Q2 net income of $108.3 million and snagged a New York DFS BitLicense. Getting regulatory approval to operate in the U.S. market is worth the celebration.

NuScale Power (SMR): Won the largest small modular reactor deployment program in U.S. history with the Tennessee Valley Authority. When your technology gets validated by a major utility, the market takes notice.

IonQ (IONQ): Announced plans to acquire Vector Atomic, expanding into quantum sensing for government and national security applications. Every acquisition that moves quantum computing closer to practical applications drives the stock higher.

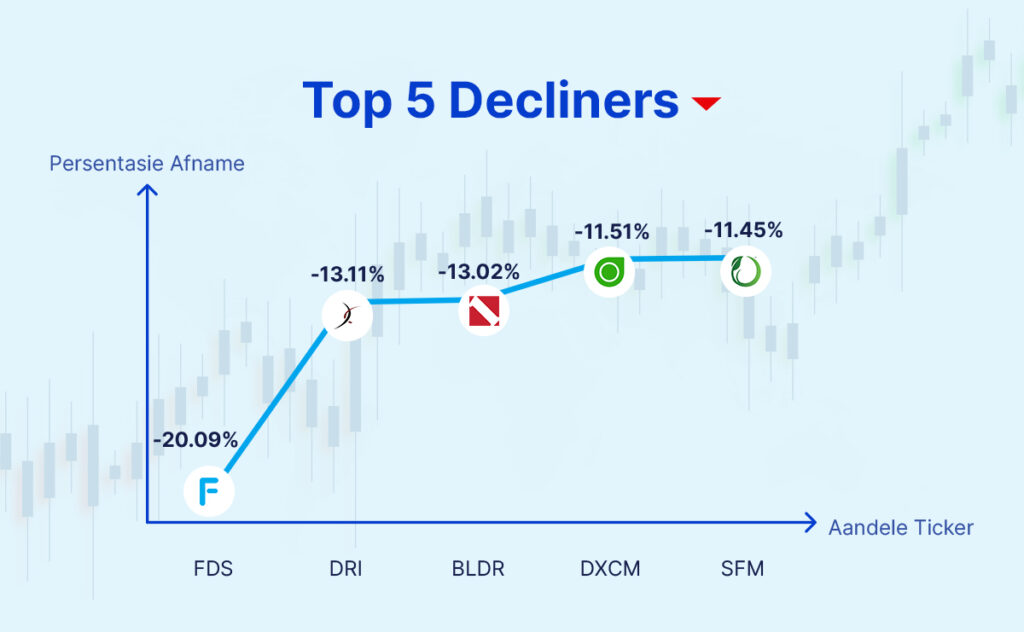

Top 5 Decliners

| Ticker | Company | Weekly Change |

| FDS | FactSet Research Systems | -20.09% |

| DRI | Darden Restaurants | -13.11% |

| BLDR | Builders FirstSource | -13.02% |

| DXCM | DexCom | -11.51% |

| SFM | Sprouts Farmers Market | -11.45% |

FactSet Research Systems (FDS): Earnings and profit forecasts came in below consensus while technology expenses weighed on margins. Had the dubious honor of being the S&P 500’s worst performer this week.

Darden Restaurants (DRI): Matched revenue estimates but profits disappointed. Rising food and labor costs are squeezing margins while their fine-dining business declined. The casual dining struggle continues.

Builders FirstSource (BLDR): Analyst sentiment shifted negative ahead of expected earnings decline. The housing market softness and volatile lumber prices are creating margin pressures.

DexCom (DXCM): Got hit by a short-seller report alleging problems with G7 glucose monitors and questioning accounting practices. The CEO’s recently announced leave of absence didn’t help investor confidence.

Sprouts Farmers Market (SFM): Amazon announced a major expansion of same-day grocery delivery, directly competing with Sprouts’ core business. When Amazon enters your market, your stock usually exits the green zone.

Equities to Watch

Earnings That Move Markets

INTC: Intel’s “historic collaboration” with Nvidia includes a $5 billion investment from Nvidia. The partnership drove Intel’s best single-day performance since 1987, up nearly 23%.

NVDA: The collaboration with Intel solidified its position as Wall Street’s most valuable company. Called it a “fusion of two world-class platforms” for the next computing era.

AAPL: iPhone 17 series and ultra-thin iPhone Air launch generated massive buzz. Wedbush raised price target to $310 on strong initial demand.

TSLA: Climbed over 5% after Musk disclosed purchasing 2.5 million shares worth $1 billion. CEO putting his money where his mouth is signals confidence.

ADBE: Reported record quarterly revenue driven by AI gains, though stock slipped on competitive concerns. Analysts maintain $461 mean price target, 30% above current levels.

META: Emphasized AI and “superintelligence” investments at Goldman Sachs conference as central to long-term growth strategy.

FDS: The week’s biggest S&P 500 decliner after missing earnings and profit forecasts while technology expenses pressured margins.

HOOD: Soared 16% in a single day after announcing S&P 500 inclusion. The stock is up over 200% year-to-date.

BIDU: Received analyst upgrade from Arete, moving from “Sell” to “Buy” with $143 price target.

CRWV: Citizens JMP upgraded from “Market Perform” to “Market Outperform” with $180 price target.

Commodities to Watch

Gold: Hit fresh all-time high of $3,685 per ounce. Global central banks now own more gold than U.S. Treasuries for the first time since 1996, driving institutional adoption.

Brent Crude Oil: Short-term spikes from Middle East tensions and Russia sanctions, but EIA forecasts decline to $59/barrel in Q4 2025 and $49 by early 2026 on inventory growth.

Natural Gas: Expected to rise through winter despite high inventories. U.S. LNG exports projected to increase 36% between 2024-2026, outpacing domestic consumption.

Copper: Bullish trend continues at $9,200/metric ton. Supply constraints from environmental regulations and mining disruptions meet robust demand from renewable energy and defense sectors.

Soybeans: November contracts lost 20¾ cents this week following U.S.-China presidential phone call. Trade policy shifts create market inefficiencies and price volatility.

FX Pairs to Watch

USD: Paradoxical rally after Fed rate cut as markets interpreted it as “hawkish cut” signaling less aggressive easing. Safe-haven flows amid global uncertainty support the dollar.

EUR: ECB held rates unchanged while Fed cut, narrowing interest rate differential. EUR/USD climbed to four-year high near 1.18 mark on policy divergence.

GBP: Rose to 10-week high against USD on Bank of England’s hawkish stance. BoE expected to hold rates steady due to sticky inflation, rate cut not anticipated until early next year.

JPY: USD/JPY trading in a tight 147.00-149.00 range. Fed cut expectations push pair lower while potential BoJ rate hike reinforces yen demand.

CAD: Weakness despite softer USD. USD/CAD maintains a bullish structure after the Bank of Canada cut rates 25bps to 2.50%.

Digital Assets to Watch

Bitcoin (BTC): Rallied to $117,484 following Fed rate cut with “surprising calm.” Maturing into store-of-value assets responding to macro policy signals. Divided outlook between potential drop to $92,000 or breakout toward $120,000.

Ethereum (ETH): “Fusaka” upgrade scheduled for December 3, 2025, to improve network data efficiency and scaling preparation. Consistent development and institutional adoption drive continued interest.

Solana (SOL): Corporate adoption surge with Forward Industries’ $1.65 billion private placement for Solana treasury strategy – largest publicly traded company adoption. DeFi Development Corp. added $15 million, bringing total holdings to $500 million.

Ripple (XRP): New spot ETF (XRPR) launched with “shockingly solid” $24 million trading volume in first hours. Analysts eye $3.66 price target on institutional appetite for broader crypto products.

Dogecoin (DOGE): New spot ETF (DOJE) debuted with $6 million first-hour volume, exceeding expectations. Showed “stronger reaction” than Bitcoin post-Fed cut, suggesting altcoin rotation.

Emerging Opportunities: Tezos completed Seoul protocol upgrade with native multisig accounts for institutional users. Hyperliquid leading year-to-date gains at 124.94% return.

ETFs to Watch

Technology Exposure

- SOXL/TQQQ: High trading volume indicates speculative interest in semiconductor and Nasdaq leverage plays

- QQQ: Core tech growth fund consistently outperforming S&P 500, goes ex-dividend this week

Safe Haven Assets

- GLD: Gold hitting all-time highs provides hedge against volatility and inflation

- SCHD: Defensive dividend play with 4% yield for portfolio diversification

What This Means for African Investors

Nuclear energy emerged as this week’s unexpected winner as governments fast-track infrastructure for AI data centers. The market is recognizing that the AI revolution requires massive, clean baseload power that only nuclear can provide at scale.

Policy divergence between central banks is creating clear currency trends – the dollar strengthening on hawkish Fed cuts while the euro and pound benefit from their central banks’ steadier approach. Meanwhile, crypto markets are maturing, with institutional adoption accelerating across multiple networks and new ETF products exceeding volume expectations.

The combination of infrastructure investment, policy clarity, and institutional adoption across sectors suggests markets are positioning for sustainable growth rather than speculative bubbles. Whether accessing opportunities through nuclear energy stocks, currency divergence trades, or emerging crypto products, patient capital deployment continues to reward fundamental analysis over momentum chasing.

Diversify Your Portfolio with Alternative Assets

Looking beyond public markets? Speak to an Opportunik Advisor to structure your alternative investment portfolio and position for the next phase of global wealth creation.