This week proved that while everyone’s obsessing over AI and Fed tea leaves, some companies are still winning the old-fashioned way: fixing their actual business problems. Warner Bros. Discovery reminded Wall Street what happens when a CEO shows up with a plan instead of just buzzwords, while a few other names demonstrated that execution beats excuses every single time.

At Opportunik, we don’t just track price movements, we translate them into wealth strategies. Here’s what moved, why it happened, and what globally minded African investors should be positioning for:

Top Movers: Winners and Losers

Top 5 Gainers

| Ticker | Company | Weekly Change |

| WBD | Warner Bros. Discovery | +55.82% |

| NBIS | Nebius | +38.09% |

| IONQ | IonQ | +33.04% |

| GLXY | Galaxy Digital | +26.44% |

| CRWV | CoreWeave | +25.67% |

Warner Bros. Discovery (WBD): David Zaslav walked into Goldman Sachs and delivered the kind of presentation that makes investors weep tears of joy. The company slashed $20 billion in debt, announced their streaming business will hit $1.3 billion in profits, and revealed plans to split into two companies by Q2 2026. Sometimes the best news is announcing you’re breaking up.

Nebius (NBIS): Landed a $17 billion cloud deal with Microsoft, then immediately raised $1 billion at a 44% premium to pre-deal prices. It’s like getting a job offer so good that banks start throwing money at you before you even ask.

IonQ (IONQ): Cleared regulatory hurdles for its $1.075 billion acquisition of Oxford Ionics. For a quantum computing company, every step toward “actually working quantum computers” translates directly to stock price momentum.

Galaxy Digital (GLXY): Sometimes stocks just move because the sector is hot and sentiment is good. No major news here, just crypto-adjacent companies catching the wave.

CoreWeave (CRWV): Here’s a wild ride. Initially crashed 33% after earnings despite 207% revenue growth, then “skyrocketed” when they launched CoreWeave Ventures. Growth narratives beat balance sheet concerns in high-demand sectors.

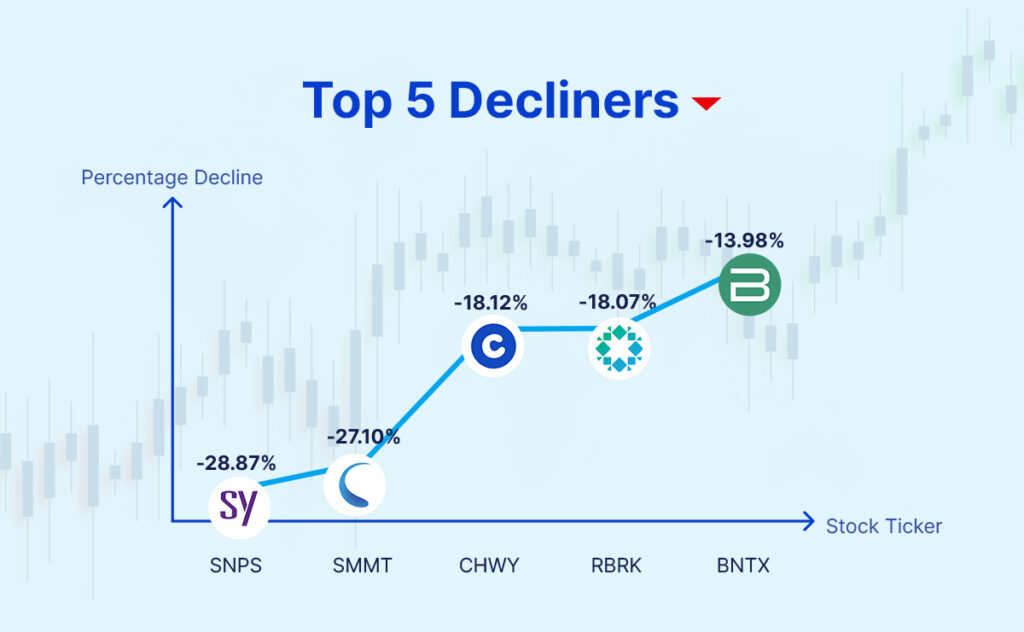

Top 5 Decliners

| Ticker | Company | Weekly Change |

| SNPS | Synopsys | -28.87% |

| SMMT | Summit Therapeutics | -27.10% |

| CHWY | Chewy | -18.12% |

| RBRK | Rubrik | -18.07% |

| BNTX | BioNTech | -13.98% |

Synopsys (SNPS): Posted revenue growth but net income fell considerably. Management admitted their Design IP segment underperformed due to export restrictions, then announced a 10% workforce reduction. When tech companies start cutting jobs, investors cut positions.

Summit Therapeutics (SMMT): Their lung cancer drug worked great in Asian patients (45% improvement) but was mediocre in Western patients (33% improvement). The FDA noticed this regional split, and shareholders noticed the FDA’s concern.

Chewy (CHWY): This makes no sense. Chewy beat earnings, raised guidance, and showed strong recurring revenue growth. Sometimes the market just has a bad day with your stock.

Rubrik (RBRK): Another head-scratcher. Beat earnings massively and grew revenue 51% year-over-year. Market logic is optional sometimes.

BioNTech (BNTX): Positive clinical data for their new COVID vaccine couldn’t overcome weak 2025 revenue guidance. Declining vaccine demand trumps incremental product improvements.

Equities to Watch

Earnings That Move Markets

- FDX: FedEx reports Q1 FY26 earnings September 18. As a major shipping company, its results are a bellwether for overall U.S. economic conditions and spending patterns.

- GIS: General Mills reports Q1 FY26 earnings September 17. Consumer spending health check via cereal and packaged goods sales.

- META: Annual developers’ conference September 17 where Zuckerberg will keynote on AI and metaverse vision, including potential AI glasses announcements.

- UBER: Strong earnings showed 18% revenue increase and significant operating income jump, plus new $20 billion buyback program signals management confidence.

Market Bellwethers

- NVDA: Post-earnings performance remains AI sector proxy

- GOOGL: Tech mega-cap resilience indicator

Commodities to Watch

Gold: Broke above $3,500/ounce on Fed rate cut expectations. When rates go down, shiny things go up.

Silver: Hit 14-year highs above $42/ounce for the same reason.

Industrial Metals: Aluminum and zinc surging on supply constraints and weakening dollar. China’s production limits plus U.S. tariffs creating perfect storm conditions.

Brent Crude Oil: Defying logic – IEA forecasts oversupply but prices stay resilient thanks to geopolitical tensions and data center demand.

FX Pairs to Watch

USD: Fed rate cuts expected while other central banks hold steady. The greenback is losing its safe-haven premium.

EUR: Positioned to benefit from dollar weakness as policy divergence widens.

CNH: Strengthening despite China’s central bank setting lower fixes – institutional positioning ahead of policy moves.

JPY: BoJ expected to resume rate hikes while Fed cuts, creating narrowing yield differential trades.

Digital Assets to Watch

Bitcoin (BTC): Holding above $116,000 despite recent dominance decline. Institutional flows remain supportive.

Ethereum (ETH): Benefiting from ETF approval momentum with over $1 billion in inflows while Bitcoin sees outflows. Smart money choosing programmable infrastructure.

Solana (SOL): Gained nearly 20% as “Ethereum-killer” narrative resurfaces with strong institutional interest.

Emerging Opportunities: Dogecoin jumped 38% on pure meme energy, while various altcoins ride sector momentum.

ETFs to Watch

Technology Exposure

- QQQ: Nasdaq 100 proxy hitting new records

- SOXL: 3X leveraged semiconductor momentum play

Safe Haven Assets

- GLD: Gold exposure for rate cut positioning

- SLV: Silver riding 14-year highs

Thematic Plays

- IBIT: Institutional Bitcoin access with massive volume

What This Means for African Investors

This week perfectly captured 2025’s market personality: fundamental business improvements drive massive returns, but sentiment matters just as much as balance sheets. The Fed’s expected rate cut creates interesting cross-currents – good for risk assets and commodities, challenging for the dollar.

Markets remain inefficient enough to reward patient, analytical capital. Whether you’re accessing opportunities through local platforms or international brokers, disciplined fundamental analysis still creates asymmetric return potential.

Diversify Your Portfolio with Alternative Assets

Looking beyond public markets? Speak to an Opportunik Advisor to structure your alternative investment portfolio and position for the next phase of global wealth creation.