For African investors in 2025, the choice between sticking with local markets and exploring alternative investments in Africa is critical because local equities and bonds alone may not provide the diversification or protection your wealth needs. Here’s what happened when currency devaluation hit African markets hard in 2022-2024: investors holding only local assets watched their wealth shrink by 40%+ in USD terms. Meanwhile, investors who allocated thoughtfully into private credit, global REITs, commodities, and other alternatives not only preserved capital but captured meaningful upside.

If you’re an African investor (whether based on the continent or in the diaspora), you’ve probably wondered: “What are the best alternative investments Africa has to offer in 2025?” It’s a fair question, especially when evaluating top alternative assets Africa’s markets present alongside their associated risks and 2025 opportunities.

This guide walks through the five best alternative investments Africa-focused portfolios should consider: private credit, real estate & REITs, commodities, digital assets, and private equity. Each comes with real data on highest potential returns, practical diversification frameworks, and honest risk assessments. It’s just what you need to capitalize on 2025 opportunities while managing risks.

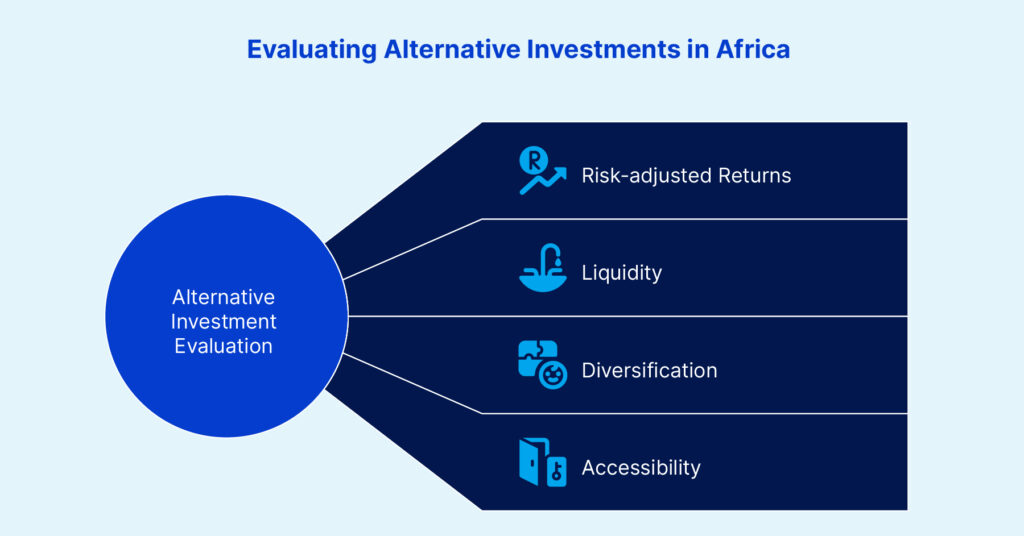

How We Rank the Best: Our Methodology

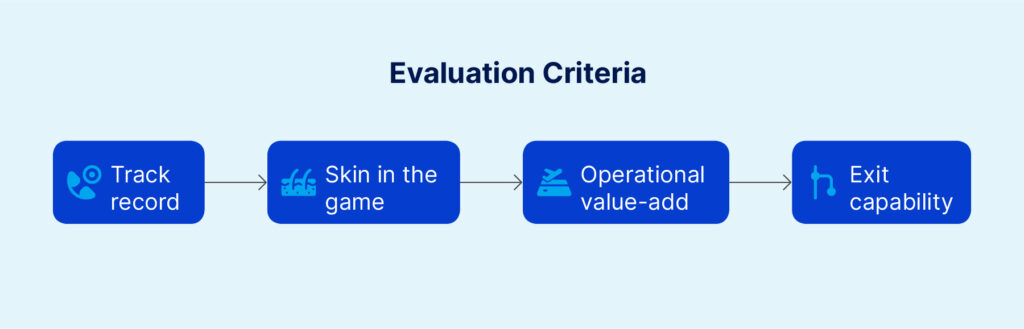

Before diving into specific investments, let’s talk about how we evaluate alternatives. At Opportunik, we don’t get swayed by headline returns or hype. Instead, we measure every opportunity against four key criteria:

Risk-adjusted returns → It’s not just about IRR, it’s about how much risk you’re taking to get there

Liquidity → Can you actually access your capital when life happens?

Diversification → How uncorrelated is this to your local stocks and currency?

Accessibility → Are the minimum investments and regulatory requirements realistic for African investors?

You see, African investors face structural challenges- currency volatility, inflation, shallow public markets that require exploring the best alternative investments Africa offers beyond traditional stock and bond allocations. The right mix of top alternative assets Africa provides doesn’t just chase the highest potential returns; it solves real diversification problems while managing opportunities and risks.

Pick #1: Private Credit in Africa

Why Private Credit is on the List

Think of private credit as becoming the bank when traditional banks won’t lend. In Africa, this isn’t just an investment strategy, it’s filling a genuine financing gap. SMEs and mid-market companies often can’t access reasonable bank financing, creating opportunities for investors who understand the space.

The numbers tell the story: globally, private credit has grown to over $1.4 trillion in assets under management, while African deal activity increased by 8% in 2023-2024 according to AVCA data. But here’s what makes this interesting for African investors- you’re not just earning returns, you’re financing businesses that create jobs and economic value.

What You Can Expect (And What Can Go Wrong)

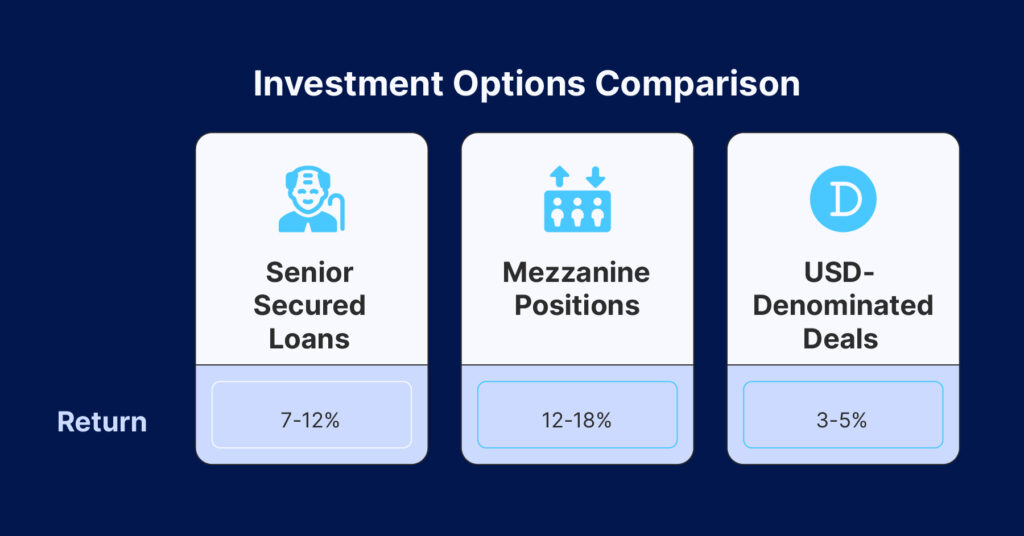

Typical returns we’re seeing:

- Senior secured loans: 7-12% net IRR

- Mezzanine positions: 12-18% net IRR

- USD-denominated deals: additional currency protection worth 3-5% annually

But let’s also mention the risks:

- Companies default (it happens, especially in concentrated sectors)

- Currency devaluation if loans are in local currency

- Legal enforcement can be challenging in some jurisdictions

- Manager selection matters enormously because not all credit shops understand African markets

Your Due Diligence Checklist

Before you commit capital, here’s what to verify:

| What to Check | Why It Matters | Red Flags |

| Loan seniority | Senior positions get paid first | Subordinated debt without appropriate risk premium |

| Collateral quality | Hard assets > receivables | Unsecured lending to early-stage companies |

| Currency exposure | USD-linked protects against FX risk | Local currency without inflation adjustments |

| Manager track record | African workout experience essential | No default/recovery data from the region |

Let’s say a Lagos investor allocated $50,000 to a Nigerian SME credit vehicle in 2022. Despite the naira’s 45% decline, they’ve earned 11.2% annual USD returns because the underlying loans were dollar-denominated and properly collateralized.

Who this fits: Investors seeking steady income who can commit capital for 3-7 years. This is particularly attractive if you want your investments to have real economic impact.

Pick #2: Real Estate & REITs

Why Real Estate & REITs are on the list

African cities are growing at 4.1% annually. That’s not a trend, that’s a structural shift creating sustained demand for quality real estate. Knight Frank’s 2024 Africa Report shows rental yields in Lagos (8-12%), Nairobi (7-10%), and Accra (9-13%) that would make European investors envious.

But here’s the real value for African investors: real estate often provides natural currency hedging. Property values tend to adjust with inflation, and if you can earn foreign income (think short-let properties for business travelers), you get the best of both worlds.

Two Ways to Play This

Income-focused approach:

- REITs: Professional management, quarterly distributions, actual liquidity

- Short-let properties: Higher yields (10-15%) but you’re essentially running a small business

- Commercial leases: Stable, longer-term income with higher ticket sizes

Growth-focused approach:

- Prime residential: Supply-constrained areas with appreciation potential

- Logistics properties: Benefiting from e-commerce and regional trade growth

- Mixed-use developments: Capturing urbanization trends directly

Short-Let vs Commercial: The Trade-Offs

| Property Type | Typical Yield | Management Intensity | Best For |

| Short-let (Airbnb) | 10-15% | High (daily operations) | Hands-on investors |

| Commercial office | 8-11% | Medium (tenant management) | Passive income seekers |

| Residential rental | 7-10% | Low (annual lease renewals) | Set-and-forget investors |

Quick reality check: A $100,000 split between Lagos short-let and Johannesburg REIT in 2020 delivered blended returns of 9.8% annually while providing both growth and income diversification.

What to Verify Before Investing

- Is the REIT properly audited and regulated?

- What’s the tenant mix and average lease length?

- Are there major supply pipelines that could flood the market?

- What currency are rents paid in?

- What are the tax implications for diaspora investors?

Who this fits: Any investor wanting inflation protection and income generation. Start with REITs for liquidity, add direct property as your expertise and capital grow.

Pick #3: Commodities (Gold and Agriculture)

Why Gold and Agriculture are on the list

Let’s be direct: commodities aren’t sexy growth plays, they’re portfolio insurance. When African currencies experienced massive devaluation in 2022-2024 (naira -45%, cedi -38% vs USD), investors with commodity exposure maintained purchasing power while others watched their wealth evaporate.

Gold’s role: Zero correlation to African equity markets, liquid global trading, easy access through ETFs. Historical returns of 4-8% USD annually, but the real value is volatility reduction and currency protection.

Agriculture angle: Farmland, agri-processing companies, specialized funds. Many offer USD-linked revenues (export crops) while benefiting from local land appreciation—a natural hedge structure.

How to Get Exposure to Gold and Agriculture

| Approach | Pros | Cons | Best For |

| Gold ETFs | Liquid, low cost, no storage | Counterparty risk | Tactical allocation |

| Physical gold | Direct ownership, crisis protection | Storage costs, less liquid | Long-term hold |

| Agri funds | Professional management | Manager selection risk | Diversified exposure |

| Direct farmland | Control, local expertise | Hands-on management | Large allocations |

Mini case: A Ghanaian investor put 20% of portfolio into a USD-linked cocoa processing joint venture in 2020. Despite local currency chaos, they maintained purchasing power and earned 8.3% annual USD returns through commodity appreciation and operational improvements.

Important questions to answer before investing in Gold and Agriculture

- Are you investing for hedging or yield generation?

- Do you understand storage and insurance costs for physical assets?

- Are you comfortable with agricultural operational risks?

- Do you know the tax treatment in your jurisdiction?

Who this fits: Anyone with significant local currency exposure who wants portfolio stability. Consider 5-20% allocation depending on your domestic risk.

Pick #4: Digital Assets

Why Digital Assets are on the list

Nigeria ranks #2 globally in cryptocurrency adoption, and there’s a good reason for that. Digital assets provide both uncorrelated returns and an alternative store of value when local financial systems are under stress. Stablecoins have become legitimate payment infrastructure across African remittance corridors.

But let’s address the elephant in the room: crypto is volatile, regulation is uncertain, and security breaches happen. This isn’t an asset class for your retirement savings, it’s a tactical allocation for investors who understand the risks.

Our Recommended Approach to Investing in Digital Assets

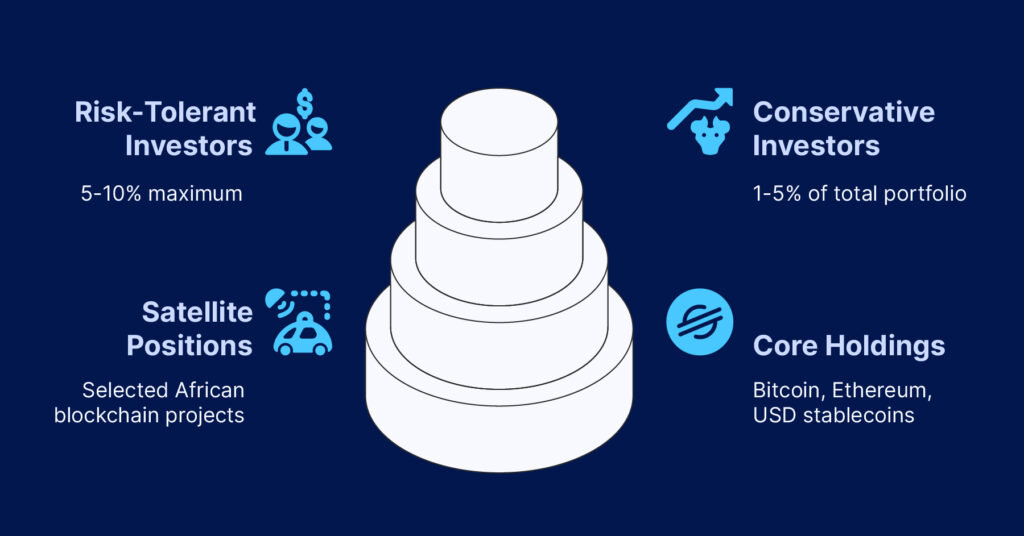

Position sizing framework:

- Conservative investors: 1-5% of total portfolio

- Risk-tolerant investors: 5-10% maximum

- Core holdings: Bitcoin, Ethereum, USD stablecoins

- Satellite positions: Selected African blockchain projects

Risk management essentials:

- Use regulated exchanges with audit histories

- Hardware wallets for significant positions

- Never borrow to invest in crypto

- Regular rebalancing to maintain target allocation

Reality check: A diversified crypto allocation in 2021 experienced brutal drawdowns in 2022 (-50%+) but recovered strongly by 2024. That’s the nature of the asset class. So, expect volatility and position size accordingly.

Due Diligence Checklist

- Exchange regulatory status and insurance coverage

- Your local tax obligations for crypto gains

- Secure custody setup (hardware wallets, multi-sig)

- Understanding of the specific projects you’re investing in

Who this fits: Investors comfortable with venture capital-style risk/return profiles. Treat it like betting on early-stage companies. Some will zero out, others might deliver extraordinary returns.

Pick #5: Private Equity

Why Private Equity is on the list

African private equity raised $4.2 billion in 2023 (up 18% year-over-year), with improving exit environments and better operational expertise. Top-quartile managers are delivering IRRs of 18-25% across recent vintages, driven by technology, financial services, and consumer sector growth.

The structural advantage is real: African PE benefits from GDP growth tailwinds (3-6% annually vs 1-2% in developed markets) while accessing companies at earlier valuation multiples than developed market equivalents.

Typical Private Equity Investment Outlook

Target returns: 15-25% net IRR for established managers

Time commitment: 5-10 years with J-curve effects

Liquidity: Essentially zero until exit events

Key risks in private equity investing

- Exit markets can be thin (limited IPO/strategic buyer options)

- Currency translation risk for USD funds

- Operational execution challenges in emerging markets

- Massive return dispersion between top and bottom quartile managers

How to Select a Good Private Equity Asset Manager

| Evaluation Criteria | What to Look For | Red Flags |

| Track record | Realized returns across full cycles | Only paper gains, no actual exits |

| Skin in the game | GP co-investment >2% of fund size | Managers not investing alongside |

| Operational value-add | Portfolio company improvement track record | Financial engineering focus only |

| Exit capability | Demonstrated exit success across conditions | No exit strategy or limited options |

Real example: A fintech Series B investment in 2019 delivered 4x MOIC for early backers when the company achieved a regional exit in 2023, but that required patient capital and the right manager selection.

Important questions to answer before investing in Private Equity

- Can you truly lock up capital for 7-10 years?

- Do you understand the fee structure and waterfall mechanics?

- Is the legal structure appropriate for your tax situation?

- If you’re investing in private equity through an asset manager, does that manager have the right sector and geographic expertise?

Who this fits: Investors with long time horizons and patient capital seeking growth exposure to African economic development. This isn’t for money you might need in the next five years.

What is the Best Alternative Investment for African?

Choosing the right alternative assets depends on factors like your goals, time horizon, liquidity needs, ticket size, and risk–return positioning. Here’s how to weigh the options as an African investor.

Time Horizon Matching

| Your Timeline | Recommended Focus | Why |

| Less than 1 year | Liquid REITs, commodity ETFs | Capital preservation, easy exit |

| 1-5 years | Private credit, REITs, agriculture | Income generation, moderate growth |

| 5+ years | Private equity, infrastructure | Growth capture, wealth building |

Liquidity Needs Assessment

High liquidity need: REITs, commodity ETFs, (carefully selected) crypto

Medium liquidity tolerance: Private credit, commercial real estate

Low liquidity concern: Private equity, farmland, infrastructure

Ticket Size Realities

Starting small (<$5,000): REITs, commodity ETFs, crypto platforms

Medium allocations ($5,000-$50,000): Private credit funds, co-investment opportunities

Large allocations (>$50,000): Direct PE, infrastructure funds, commercial real estate

Risk-Return Positioning

| Your Profile | Suggested Mix | Key Focus |

| Conservative | 40% REITs, 30% private credit, 20% commodities, 10% digital assets | Income and stability |

| Balanced | 30% REITs, 25% private credit, 20% PE, 15% commodities, 10% digital | Growth and income |

| Aggressive | 40% PE, 25% real estate, 20% private credit, 15% digital assets | Maximum growth potential |

Our Insight: Start with 5-15% total portfolio allocation to alternatives, scaling to 15-30% as you gain experience and comfort. Don’t try to hit a home run on your first swing.

Frequently Asked Questions on Alternative Investment

Q: Which alternative investment offers the highest potential returns?

A: Private equity typically offers the highest return potential (15-25% IRR targets), but it comes with the longest lock-up periods and highest risk. Digital assets can deliver exceptional returns but with extreme volatility.

Q: What’s the most liquid alternative investment option?

A: REITs and commodity ETFs offer the best liquidity, allowing you to exit positions within days. Private credit and real estate funds typically have longer redemption periods.

Q: What are the best alternative investments Africa offers for beginners?

A: Among the top alternative assets Africa presents, REITs and commodity ETFs offer the best starting point, providing diversification and managing risks while requiring smaller initial investments ($1,000-$5,000). These present solid 2025 opportunities without the complexity of private markets.

Q: Which option works best for small ticket sizes?

A: REITs, commodity ETFs, and digital asset platforms accommodate smaller initial investments ($1,000-$5,000). Private credit and PE typically require higher minimums ($25,000+).

Q: How do I manage currency risk across these investments?

A: Prioritize USD-denominated or USD-linked investments. Private credit with dollar contracts, international REITs, gold, and stablecoins all provide natural currency hedging.

How to Get Started with Alternative Investment

Ready to move from analysis to action? Here’s a sample step-by-step plan in alternative asset investing:

Phase 1: Foundation

- Audit your current portfolio— Calculate exactly how much of your wealth is tied to local currency (target: less than 60%)

- Set up access— Open accounts with alternative investment platforms and brokers.

- Start small— Deploy 3-5% to liquid alternatives (REITs, commodity ETFs) to get comfortable

Phase 2: Building

- Research private managers—request track records and documentation from 3-5 private credit or PE managers

- Pilot allocations—make an initial deposit across 2-3 categories

- Establish tracking—set up quarterly performance reviews and rebalancing protocols

Phase 3: Scaling

- Double down on winners—increase allocations to strategies showing good risk-adjusted returns

- Add complexity—consider direct investments or co-investment opportunities

- Optimize structure—review tax efficiency and legal structures with qualified advisors

Success Metrics to Track in Alternative Investments

- Portfolio volatility reduction compared to all-local allocation

- Real returns (after inflation and currency effects)

- Correlation improvement vs local market benchmarks

- Income generation from alternative sources

Remember: The goal isn’t to get rich quick, it’s to build a more resilient portfolio that can preserve and grow wealth across different market environments. Start with what you understand, invest only what you can afford to lose in illiquid strategies, and scale your knowledge alongside your allocations.

The best alternative investment strategy is the one you can stick with through market cycles. Choose wisely, start conservatively, and give your selections time to work. But you do not have to do all the work, we can help you do it here.

This analysis is for educational purposes and does not constitute investment advice. Alternative investments involve significant risks including potential loss of principal, illiquidity, and concentration risk. Past performance does not guarantee future results. Always consult with qualified financial advisors familiar with your specific situation before making investment decisions.