Alternative investments in Africa are no longer just for the ultra-wealthy, they’ve become essential for investors serious about protecting and growing their wealth. Across the continent and within the diaspora, investors are moving beyond stocks, bonds, and local real estate, looking for opportunities that shield them from currency swings, inflation, and market volatility. The numbers tell the story. For example, the Nigerian naira has lost over 70% of its value in the past five years, and Ghana’s cedi fell by more than 50% against the dollar in 2022. When your local currency can erode that fast, “business as usual” investing doesn’t cut it.

That’s why alternatives have moved from being optional to essential, they help preserve purchasing power, diversify portfolios, and access deals that public markets can’t always offer. From private equity and venture-backed startups to infrastructure, commodities, and impact-driven projects, alternative investments are reshaping the way African capital works. Whether it’s private equity in Lagos, farmland in Zambia, or renewable energy in Kenya, success requires strategy, awareness of local dynamics, and a willingness to explore beyond conventional portfolios.

In this guide, we’ll break down what alternative investments in Africa are, why they matter, the types of assets available, associated risks, and actionable steps to get started. Whether you’re on the continent or part of the African diaspora, this roadmap is designed to help you harness Africa’s growing investment potential while navigating its unique challenges.

What Alternative Investments in Africa Means

Globally, alternative investments are asset classes outside traditional stocks, bonds, and cash. In Africa, these include:

- Private equity (PE) and venture capital (VC)

- Private credit

- Real estate and REITs

- Infrastructure projects

- Commodities like gold, cocoa, or agricultural products

- Digital and blockchain-based asset

These assets often take unique forms shaped by local market conditions, regulations, and infrastructure realities. What makes them “alternative” isn’t just the asset type, it’s also how they’re accessed, usually through private deals, specialized funds, co-investment syndicates, or niche digital platforms. They’re generally less liquid, less regulated, and less correlated to public markets, but they can deliver outsized returns when approached with rigorous due diligence.

Snapshot of Alternative Assets in Africa:

| Asset Type | Common Forms | Typical Returns | Liquidity |

| Private Equity | Growth-stage companies, buyouts | 15–25% IRR | 7–10 years |

| Venture Capital | Startups in fintech, healthtech | 20–35% IRR | 5–7 years |

| Private Credit | Trade finance, mezzanine loans | 8–15% | 3–5 years |

| Real Estate/REITs | Residential, commercial, industrial | 7–12% | Medium (REITs) |

| Infrastructure | Toll roads, energy plants | 6–10% | 10–20 years |

| Commodities | Gold, cocoa, agriculture | 5–15% | Medium to long |

| Digital Assets | Crypto, tokenized securities | Highly variable | High volatility |

Why Alternatives Matter for African Investors

For African investors, three major forces make alternatives particularly compelling: inflation and currency depreciation, gaps in public markets, and diversification needs.

1. Inflation and Currency Effects

Many African currencies have experienced sustained depreciation against the US dollar, euro, and pound. Inflationary pressures, rising food prices, energy costs, and subsidies, erode savings in local cash or fixed-income instruments. Alternatives, especially those priced in hard currencies or linked to global commodity prices, act as hedges and preserve purchasing power. For example, investing in a gold mine in South Africa or an offshore REIT paying USD dividends can act as shields against local currency shocks.

2. Access Gaps in Public Markets

Public stock exchanges in Africa are often narrow and illiquid. While the Johannesburg Stock Exchange is relatively mature, markets in Nigeria, Kenya, and Ghana have fewer listed companies concentrated in banking, telecoms, and consumer goods.

This is where alternative investments come in.

Alternative assets broaden the investment landscape, offering access to global opportunities, private businesses, cross-border infrastructure projects, and commodity-linked returns unavailable on public exchanges.

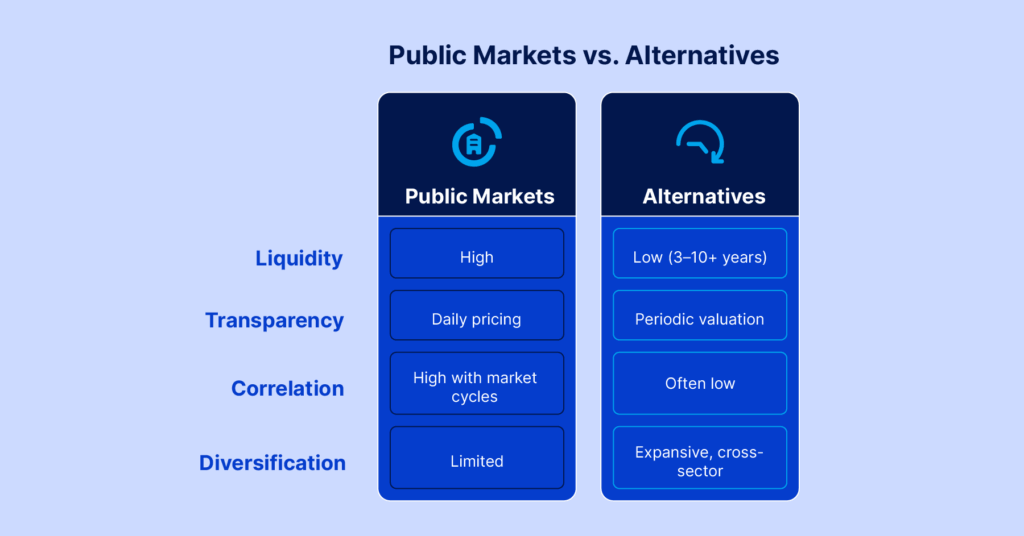

Before you make allocation decisions, check these differences:

Comparing Public vs. Alternative Investments:

| Feature | Public Markets | Alternatives |

| Liquidity | High | Low (3–10+ years) |

| Transparency | Daily pricing | Periodic valuation |

| Correlation | High with market cycles | Often low |

| Diversification | Limited | Expansive, cross-sector |

Types of Alternative Assets in Africa

1. Private Equity and Venture Capital

Private equity targets established businesses needing growth capital or operational improvements, while venture capital focuses on high-growth startups in sectors like fintech, e-commerce, healthtech, and agritech. A case study would be a Lagos-based fintech raising $10 million in Series B funding could offer early investors exponential returns if it scales successfully. The upside? Potentially exponential returns. The downside? One wrong bet can wipe out the gains from three right ones. Now, before you commit capital, it’s important to ask: Do I understand this business well enough to explain it to a teenager? If not, you’re speculating, not investing.

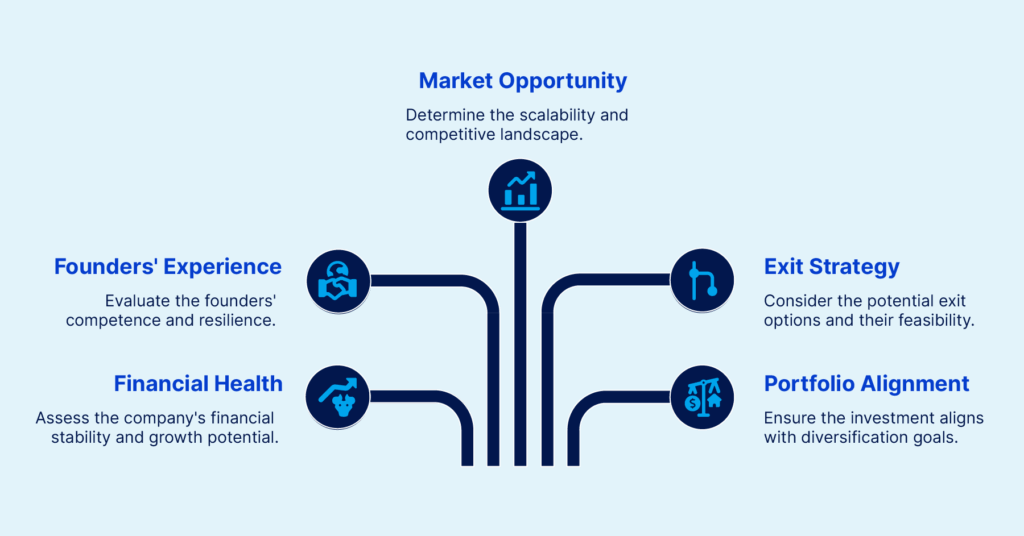

Check these key factors:

PE/VC Investment Checklist:

- Company financial health and growth trajectory- Do they have solid financials and a believable growth plan?

- Founders’ experience and track record- Competence and resilience matter as much as the idea.

- Market opportunity and competition- Is there enough room to scale?

- Exit strategy- Would there be an IPO, acquisition, or a buyout? Hope is not a strategy.

- Alignment with portfolio diversification goals- Does it balance your other risk exposures?

2. Private Credit

Private credit involves lending directly to businesses or projects outside the traditional banking system. It includes senior secured loans, mezzanine financing, and trade finance. Think of it as financing a cocoa export business in Ghana with a fixed USD-denominated return provides predictable cash flows while hedging local currency risk. Now, if you’re not ready to enforce contracts across continents, this isn’t your lane yet.

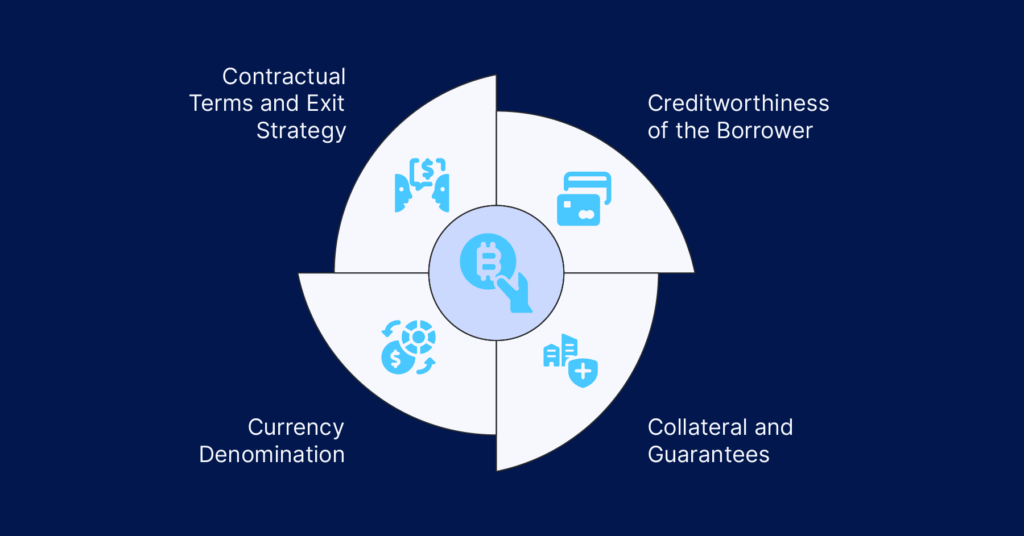

Before lending, make sure you’ve evaluated these essentials:

Private Credit Checklist:

- Creditworthiness of the borrower- Can they actually repay?

- Collateral and guarantees- What’s your safety net?

- Currency denomination- Is it local or hard currency?

- Contractual terms and exit strategy- These include the Repayment schedule, exit terms and penalties.

A tip would be to use private credit for predictable cash flow, but make sure to conduct strong due diligence on borrowers and contracts. And remember, this is not financial advice.

3. Real Estate and REITs

Africa’s urban population is growing rapidly, driving demand for housing, commercial, and industrial spaces. REITs in Kenya, South Africa, and Nigeria let investors access property income without directly managing assets. As an investor, if you can’t hold through a downturn, don’t play in this cycle, and if you choose to invest, review these points:

Market Snapshot

| Market | Type | Average Yield | Liquidity |

| South Africa | Commercial REIT | 8–10% | Medium |

| Kenya | Residential REIT | 6–8% | Medium |

| Nigeria | Mixed-use | 7–9% | Low–Medium |

4. Infrastructure

Investments in roads, railways, ports, or energy plants are often structured as public-private partnerships (PPPs). They offer long-term, inflation-linked cash flows but require significant capital and regulatory navigation. It’s important to consider these points carefully before investing in long-term projects and while you invest, treat it like planting a baobab tree, long to grow, but once it does, it’s steady.

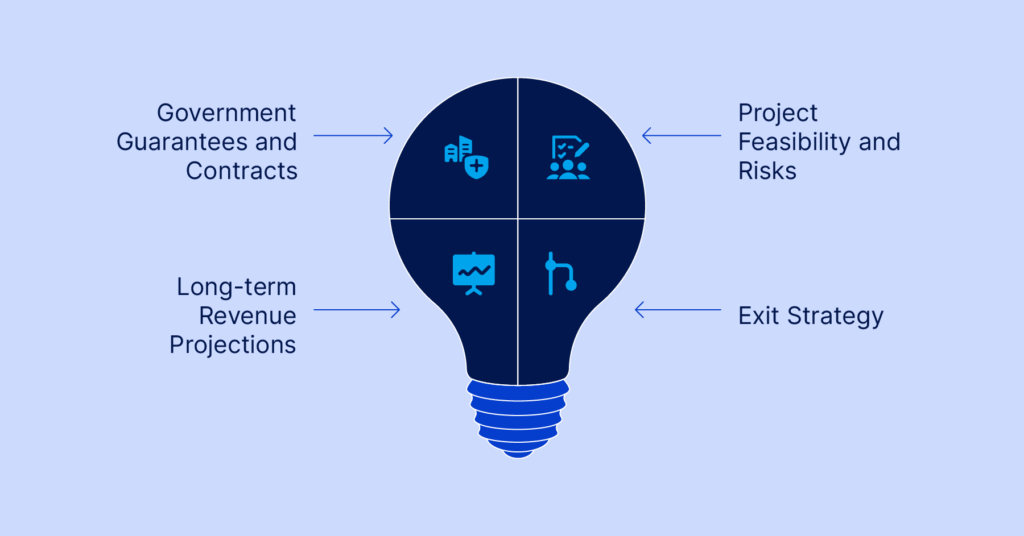

Infrastructure Checklist:

- Government guarantees and contracts

- Project feasibility and risks

- Long-term revenue projections

- Exit strategy

5. Commodities (Gold, Agriculture)

Africa’s natural resources make commodities core alternatives. Gold, platinum, cocoa, and coffee provide a hedge against inflation and currency depreciation, but if you can’t stomach volatility, commodities will test your patience. As always, get a checklist that includes:

Commodity Exposure Checklist

- Physical vs. equity investment

- Price volatility trends

- Global demand forecasts

- Storage and operational costs

6. Digital Assets

Cryptocurrencies and tokenized assets are speculative and volatile, but offer high growth potential. Blockchain allows fractional ownership of real estate, art, or infrastructure. Stablecoins can protect against local currency depreciation and if you’re not ready for 50% drawdowns, you’re not ready for this space.

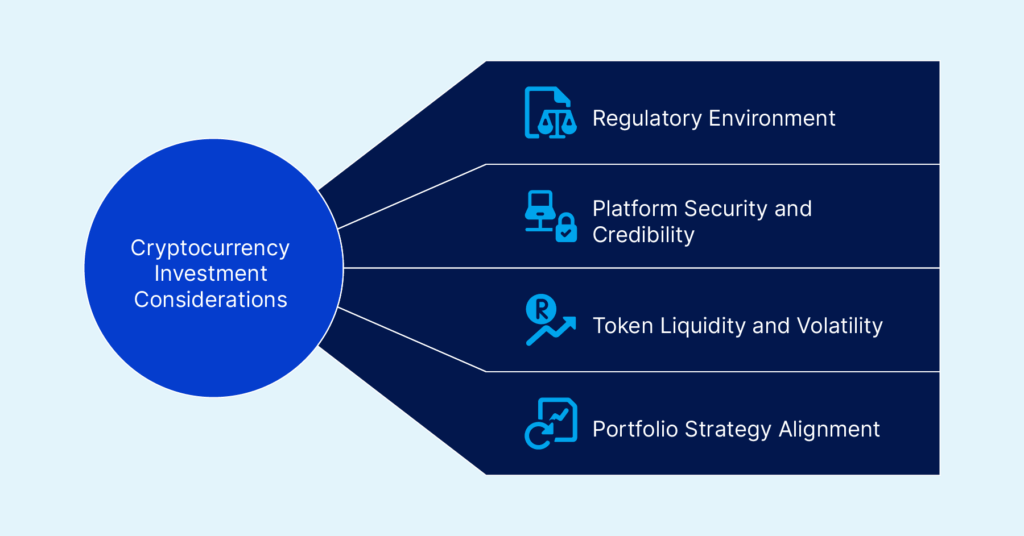

Digital Asset Checklist:

- Regulatory environment

- Platform security and credibility

- Token liquidity and volatility

- Alignment with overall portfolio strategy

Risk, Return, and Correlation Basics

Think of every alternative investment as a three-part equation. Before you move a single dollar into alternatives, understand how they behave. These three levers will determine whether your portfolio thrives or sinks.

- Volatility and Drawdowns: It’s the quiet roller coaster. Alternative assets don’t shout with daily price swings like public stocks, but that calm can be misleading. A single failed startup, commodity crash, or stalled infrastructure project can wipe out years of gains. Always size positions so you can absorb a worst-case scenario without derailing your entire plan. Alternatives can be less volatile day-to-day but risk significant loss in cases like startup failures or commodity shocks.

- Liquidity Timelines: In private equity, infrastructure, or certain real estate deals, your capital can be locked away for 3 to 10+ years. If you might need quick access to cash, alternatives could become a trap instead of a tool. Invest only what you can comfortably set aside for the long term.

- Diversification Benefits: The true power of alternatives is that they often zig when public markets zag. Used well, they can cushion your portfolio during equity downturns. But diversification works only if you spread exposure across multiple sectors, geographies, and risk profiles. Alternatives reduce correlation with public markets, offsetting equity losses during downturns.

Fees, Minimums, and Access Routes

Before you dive in, remember: in the world of alternative investments in Africa, the how matters just as much as the what.

Access Vehicles – You’ll usually come in through:

- Funds – professionally managed pools targeting specific asset classes.

- Syndicates – investor groups pooling capital for larger deals.

- Digital Platforms – newer, tech-driven marketplaces that give smaller investors a seat at the table.

Eligibility – Regulators often require a certain income or net worth to participate. It’s not about excluding people, it’s about making sure you can handle the risks without sinking your financial ship.

Before you commit capital, walk through this due diligence checklist:

- Understand the asset and the sector, can you explain it in one sentence?

- Review the manager’s real track record, not just their pitch deck.

- Confirm regulatory compliance, especially across borders.

- Clarify your exit timelines; avoid getting stuck in a deal with no end in sight.

- Assess currency exposure, returns can vanish if the local currency slides.

- Make sure the investment aligns with your objectives, not just the fund’s goals.

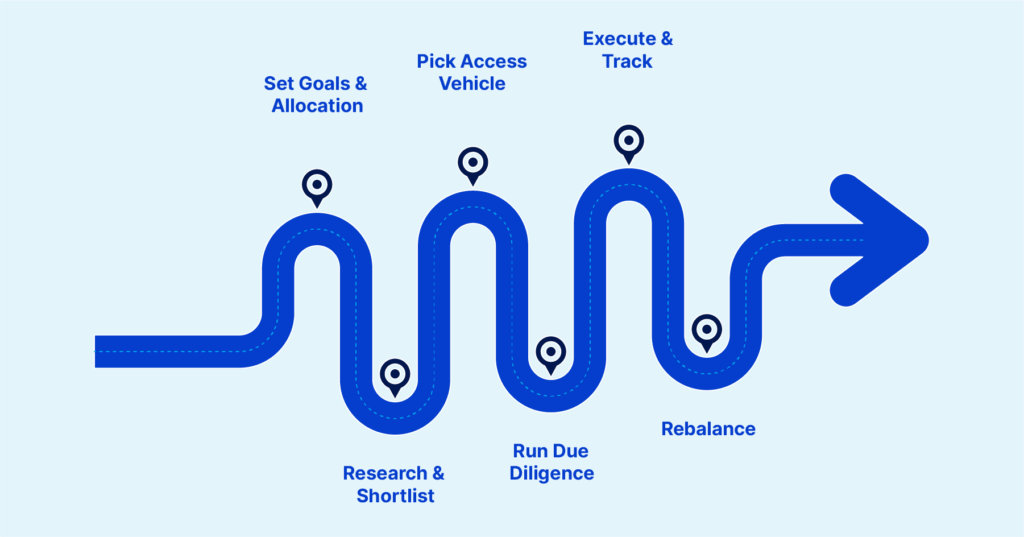

How to Get Started

Here’s your playbook for entering the market with confidence:

- Set Goals & Allocation – Is your aim income, capital growth, or inflation protection? Most seasoned investors start with 5–20% in alternatives.

- Research & Shortlist – Focus on sectors you understand or can quickly get up to speed on.

- Pick Your Access Vehicle – Choose between funds, direct deals, or vetted platforms based on your budget and control preferences.

- Run Due Diligence – Apply the checklist above with zero shortcuts.

- Execute & Track – Commit your capital and keep impeccable records.

- Rebalance – Review annually; adjust for sector exposure, returns, and currency swings.

Common Mistakes to Avoid

- Overallocating to illiquid assets – Being “asset-rich, cash-poor” can kill your flexibility when opportunity knocks.

- Ignoring currency and geopolitical risk – A high-yield project in a politically unstable country can wipe you out overnight.

- Failing to diversify – Putting all your alternative eggs in one basket is just bad investing.

- Skipping due diligence – If you haven’t done your homework, you’re gambling, not investing.

- Misunderstanding legal structures – The wrong entity type can trap you in unexpected tax or liability headaches.

FAQs

Q: What qualifies as an alternative investment in Africa?

A: Any asset outside public stocks, bonds, or cash, including private equity, private credit, real estate, infrastructure, commodities, and digital assets.

Q: Are alternative investments risky?

A: Yes, they carry unique risks like illiquidity, valuation uncertainty, and political factors, but can offer higher returns and diversification.

Q: How much should a beginner allocate?

A: Start with 5–10% of investable capital, increasing as experience and confidence grow.

Conclusion

Alternative investments in Africa are reshaping wealth creation. From private equity in Nairobi to farmland in Zambia, opportunities are vast, and so are the risks. Success depends on disciplined due diligence, thoughtful allocation, and a long-term view.

If you’re ready to explore, start by defining objectives, understanding the instruments, and speaking with an advisor who knows both African realities and global markets. The continent’s alternative investment landscape is evolving fast, and those who approach it thoughtfully will be best positioned to benefit.