Welcome to another week of financial insights with Opportunik, your trusted companion for the best investment opportunities for Africans at home and in the diaspora. From the latest on cryptocurrencies and the Eurozone recession to the U.S. treasury’s low cash balance, we traverse the global financial landscape, focusing on the implications for Nigeria and the wider African diaspora. So buckle up and let’s dive into this week’s most influential events.

The US Cryptocurrency Conundrum

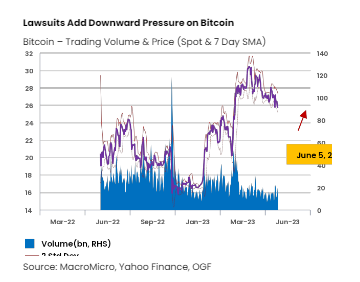

In the ever-evolving world of cryptocurrencies, leading exchanges Binance and Coinbase found themselves in a regulatory tug-of-war. Following the SEC’s accusations of breaching US securities laws, Bitcoin’s price dropped a chilling 6%, the lowest it has been in three months.

For Africans in the diaspora considering dipping their toes in crypto investment, these events might seem disconcerting. However, a more regulated market could offer better investor protection and clarity, reducing cryptocurrency market volatility.

Eurozone’s Double Whammy

The Eurozone is facing a precarious economic situation, teetering on the brink of a shallow recession. A succession of GDP contractions, driven by tightening monetary policies and a slowdown in exports, paints a grim picture.

This development has significant implications for Africans in the diaspora. The rising global uncertainty could strengthen the demand for USD, posing a challenge to emerging and frontier market currencies. Nigeria, among other African economies, might need to brace for a potentially bumpy ride.

US Treasury’s Cash Balance Conundrum

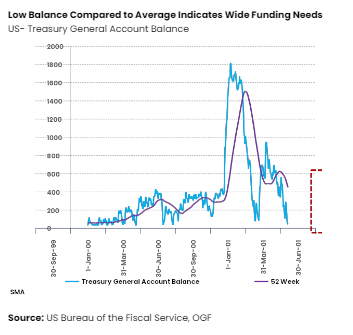

The US Treasury’s cash balance has shrunk to a meager USD 45 billion, indicating a substantial need for borrowing. As the US scrambles to attract investors to new government debt, higher interest rates loom. This situation could cause tremors in Africa and the diaspora, specifically impacting decisions about the best dollar investments in Nigeria and beyond.

Implications for African and Diaspora

Investing wisely in today’s global economy is critical for Africans and the diaspora middle class.

Despite volatility in the cryptocurrency sector, regulatory advancements offer a glimmer of hope, particularly for risk-averse investors among Nigeria’s diaspora.

The Eurozone slowdown might raise USD demand, suggesting diversification as the optimal strategy for African investors.

As the US Treasury seeks more borrowing, African nations may have to increase interest rates on securities, making it crucial for those considering private equity in Nigeria to reassess their fixed-income investments.

At Opportunik, we’re here to guide you on this investment journey. Whether you’re part of the African diaspora or based on the continent, our focus is to help you make the most of global financial trends.

If you want to learn more about investing as an African, subscribe to our newsletter and get the latest updates from Opportunik.