Welcome to October. This week proved that sometimes the biggest threats come from the most unexpected places. While everyone watched the Fed, OpenAI quietly dropped a product that sent DocuSign tumbling 14% in an afternoon. Meanwhile, space companies are securing spectrum rights, quantum computing firms are landing actual purchase orders, and the market is learning that regulatory clarity matters more than revenue projections.

Top Movers: Winners and Losers

Top 5 Gainers

| Ticker | Company | Weekly Change |

| ASTS | AST SpaceMobile | +38.03% |

| SNDK | SanDisk | +32.22% |

| RGTI | Rigetti Computing | +28.48% |

| BE | Bloom Energy | +28.40% |

| AVAV | AeroVironment | +24.38% |

AST SpaceMobile (ASTS): Surged 38% after settling spectrum access terms with Ligado, with usage payments starting September 30th. When regulatory clarity removes the biggest bottleneck to commercialization, the market rewards it immediately. Analysts project 11,028% revenue growth to $544 million.

SanDisk (SNDK): Jumped 32% on Bernstein’s “Outperform” rating, positioning it as a data storage infrastructure play for AI and quantum computing. Sometimes being a boring component supplier becomes exciting when your customers are building the future.

Rigetti Computing (RGTI): Rose 28% after securing $5.7 million in quantum computing system orders. The dollar amount is modest, but tangible commercial validation in a speculative sector drives aggressive revaluation.

Bloom Energy (BE): Gained 28% on bullish analyst projections highlighting $1.47 billion in revenue, despite a -15.5% pretax profit margin. Growth-at-any-cost valuation meets the green transition narrative.

AeroVironment (AVAV): Up 24% after winning a $499 million, 10-year U.S. Air Force contract for electromagnetic spectrum survivable materials. Citizens raised the price target from $325 to $400. Year-to-date gain of 136% versus 43% for the aerospace/defense ETF.

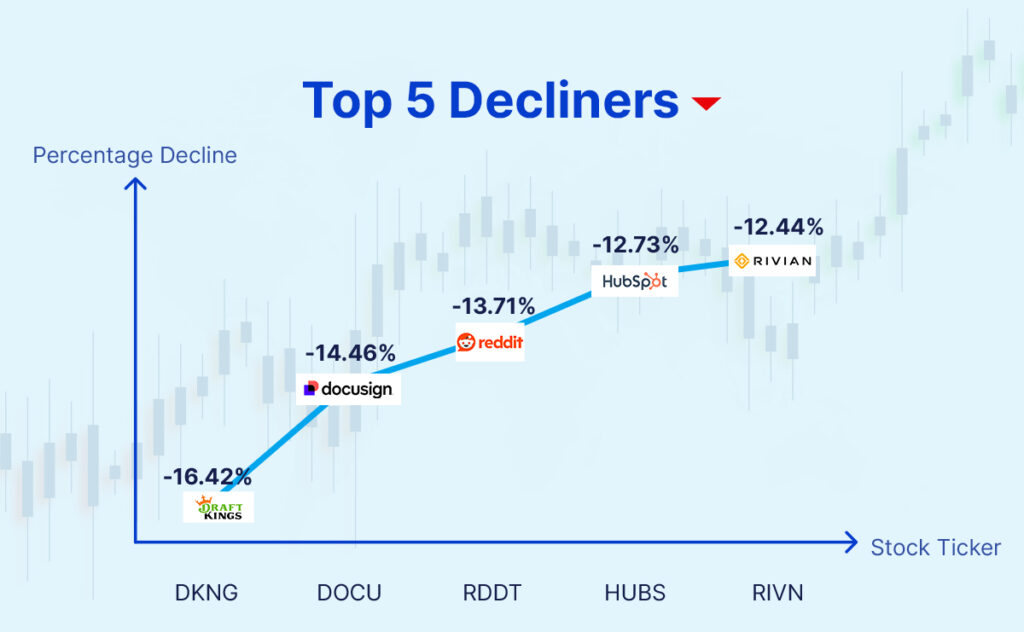

Top 5 Decliners

| Ticker | Company | Weekly Change |

| DKNG | DraftKings | -16.42% |

| DOCU | DocuSign | -14.46% |

| RDDT | -13.71% | |

| HUBS | HubSpot | -12.73% |

| RIVN | Rivian | -12.44% |

DraftKings (DKNG): Plummeted 16% on dual threats, Ohio’s governor calling for prop betting bans and surging competition from Kalshi ($275M weekend volume) and Robinhood (4B event contracts). High-margin segments under regulatory fire while competitors fragment the market.

DocuSign (DOCU): Crashed 14% after OpenAI unveiled DocuGPT, an AI product achieving near-100% accuracy in transforming contracts into searchable data. When a foundational AI leader enters your market, your competitive moat evaporates instantly.

Reddit (RDDT): Fell 14% as ChatGPT citations and daily active users dropped dramatically, undermining its AI data licensing revenue model. Analyst downgrades and overvaluation concerns triggered profit-taking as the AI data licensing thesis crumbled.

HubSpot (HUBS): Down 13% amid sector-wide SaaS weakness and profit-taking ahead of potential government shutdown. Dropped 9.29% in a single day alongside peers Braze (-8.29%) and Salesforce (-3.24%).

Rivian (RIVN): Declined 12% ahead of Q3 production/delivery figures (10,720 produced, 13,201 delivered). Market anticipated disappointment, pricing in concerns about scaling efficiency and cash burn despite delivery beats.

Equities to Watch

Gold: Extraordinary rally toward $4,000/ounce driven by inflation fears, Fed independence skepticism, and fiscal/geopolitical risks. Institutional capital flowing consistently into bullion-backed ETFs.

Silver: High-volatility precious metals play up 64% year-to-date. Supported by monetary safe-haven demand and tight supplies for industrial applications.

Platinum: Pure tight-supply structural play posting 92% YTD gain—highest among precious metals. Sensitive to Eurozone/UK industrial demand.

Brent Crude: Consolidating around $65/barrel after OPEC+ agreed to 137,000 bpd production increase. Price action depends on US economic data versus 2026 oversupply concerns.

Cocoa Futures: Tactical volatility opportunity after 10% slump to 1½-year low. Higher farm-gate prices in Ghana and Ivory Coast expected to unlock withheld stocks.

Commodities to Watch

JPY: Massive volatility after Sanae Takaichi’s LDP election victory. Support for fiscal stimulus and reduced monetary tightening widened rate differentials, pushing USDJPY above 150.00 and elevating intervention risk.

USD: Directional anchor supported by fiscal instability concerns. FOMC minutes and Powell speech scrutinized for rate path clues emphasizing inflation control versus job market weakness.

EUR: Constrained by Eurozone stagnant momentum. EUR/USD failed to break 1.1750 resistance while EURJPY posted a record high above 176.00. Bearish pressure building ahead of FOMC minutes.

GBP: Under pressure from declining economic momentum and steep UK job losses. House price data and recruitment surveys key for confirming or alleviating bearish sentiment.

AUD: Trading sideways against USD as risk-on/risk-off barometer for Asia/China growth. Fed communications or geopolitical shifts could break current consolidation.

FX Pairs to Watch

USD: Central focus with a dense economic calendar including Fed rate cut announcement mid-week and NFP Friday. Direction determines the entire FX market movement.

EUR: EUR/USD tied to Dollar Index sentiment, watching for ECB-Fed policy divergence signals that could spur breakout from consolidation range.

GBP: GBP/USD trading near critical technical levels with extreme volatility expected into NFP release as market seeks guidance on Fed’s dovish intentions.

JPY: USD/JPY driven by Treasury-JGB yield spread differentials. Expected rate cut should narrow spread, but strong NFP could provide counter-trend lift.

AUD: Commodity-linked currency benefiting from base metals rally, particularly copper supply disruptions. Global risk sentiment stabilization provides a buffer against USD strength.

Digital Assets to Watch

Bitcoin (BTC): Surging toward new all-time high of $125,580 as macro-asset and uncorrelated hedge. Bitcoin ETFs recorded the second-strongest week ever with $3.2 billion in inflows.

Ethereum (ETH): Primary regulatory play after SEC introduced generic listing standards for commodity-based ETPs, streamlining spot Ethereum ETF path for institutional capital.

Chainlink (LINK): Critical infrastructure asset viewed as “quiet giant ready to run” post-Bitcoin consolidation. CCIP positioning it as essential middleware for RWA tokenization.

Ripple (XRP): Bulls targeting $5.00 as banking license application advances. Trading above $3.00 as a high-market-cap compliance-focused token.

Hyperliquid (HYPER): High-speed Perpetual DEX representing focus on next-generation decentralized derivatives and risk transfer utility.

Emerging Opportunities: Saros distinguishing itself as an actively-used DeFi layer versus purely speculative projects. Meme coins Maxi Doge and Pepenode capture speculative retail liquidity.

ETFs to Watch

Growth Positioning

- VGT: Top tech sector performer at 19.9% YTD, primary vehicle for Fed rate cut beneficiary positioning

- XLF: Critical ahead of major bank earnings (JPM, GS, WFC) showing 13.2% YTD, pricing net interest margin expectations

Diversification Plays

- VEA: Leading international equity ETF with 27.1% YTD return for US risk diversification

- XLI: Industrial infrastructure indicator at 17.3% YTD showing domestic spending resilience

Safe Haven

- GLD: Direct gold exposure with 45.6% YTD return, targeting $4,000/ounce on inflation/geopolitical risk allocation

What This Means for African Investors

October opened with a reminder that competitive threats don’t always come from expected rivals. OpenAI’s entry into document automation sent DocuSign plummeting, while regulatory clarity propelled AST SpaceMobile skyward. The market is learning to distinguish between revenue growth and regulatory risk, between speculative projections and commercial validation.

Gold’s march toward $4,000 and Bitcoin’s surge to new highs signal deep institutional concern about traditional macro stability. When both digital and physical safe havens rally simultaneously, it suggests investors are hedging multiple scenarios, inflation, geopolitical instability, and currency debasement.

The quantum computing and space infrastructure sectors are transitioning from pure speculation to commercial proof points. Small purchase orders and spectrum settlements matter more than patent portfolios when valuations depend on demonstrating execution capability.

As we settle into Q4, the market faces a dense catalyst calendar: major earnings, Fed communications, and escalating competition across previously stable sectors. Position accordingly, because October tends to separate momentum from fundamentals rather brutally.

Diversify Your Portfolio with Alternative Assets

Looking beyond public markets? Speak to an Opportunik Advisor to structure your alternative investment portfolio and position for the next phase of global wealth creation.