Alternative investments vs traditional investments Africa: which approach works when the rules change? 2023 proved the difference matters. Nigerian inflation hit 33%. The Ghana cedi lost 50% against the dollar. South African bonds delivered negative real returns for the third straight year. Meanwhile, investors with commodity exposure and international real estate largely preserved their wealth.

The lesson isn’t that traditional investments are broken, it’s that relying solely on local stocks, bonds, and cash leaves African investors dangerously exposed to forces beyond their control. Currency volatility, high inflation, and shallow local markets that offer limited diversification create challenges that traditional investment advice simply doesn’t address.

If you’ve read our guides on what alternatives are and which ones to consider, you know the options exist. The critical question now: when to choose alternatives over traditional investments, and how do you build a portfolio that can actually survive African economic realities?

Understanding the difference between alternative and traditional investments becomes essential when local currencies can lose 40% of their value in a year and inflation regularly outpaces bank deposit rates.

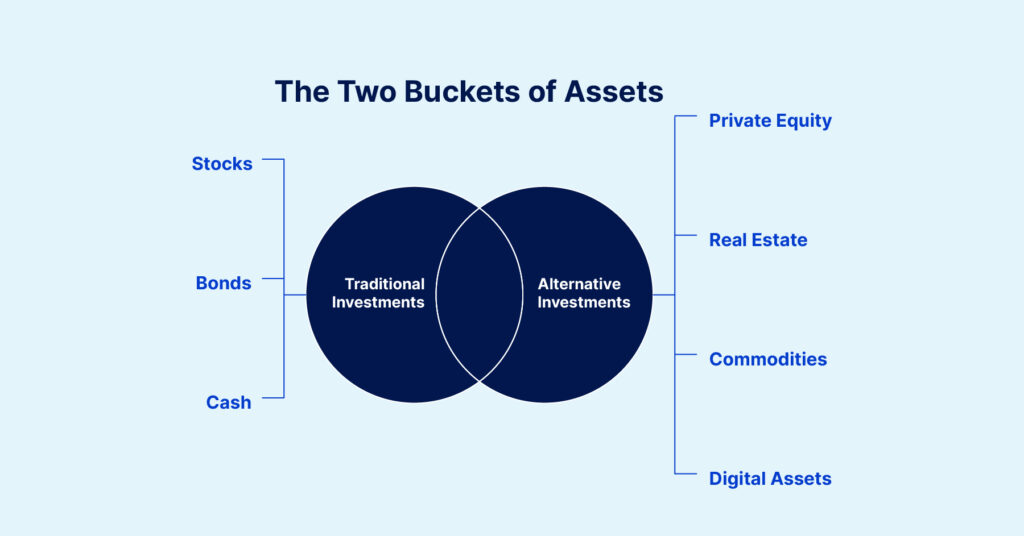

The Two Buckets of Assets: Traditional Investments vs Alternative Investments

Every investment you’ll ever make falls into one of two buckets. Understanding these buckets shapes whether your wealth grows or gets slowly eroded by forces beyond your control.

Bucket One: Traditional Investments These are the familiar investments most people think of when they hear “portfolio.” They’re traded on public exchanges, priced daily, and you can buy or sell them easily during market hours. Think of them as the foundation of most portfolios worldwide.

Bucket Two: Alternative Investments These are everything else, investments that don’t trade on public exchanges, often require longer holding periods, and typically have higher minimum investments. They provide access to returns that don’t march in lockstep with your local economy.

The key insight: relying solely on Bucket One often means your wealth moves up and down with local economic conditions, currency fluctuations, and the limited depth of African stock markets. Bucket Two offers exposure to non-correlated assets that respond to different economic drivers entirely.

Definitions: Understanding What You’re Actually Buying

Traditional Investments

Stocks (Equities): Ownership shares in publicly traded companies. When you buy Dangote Cement or MTN shares, you own a tiny piece of those businesses. Your returns come from dividends and share price appreciation, but both depend heavily on local market conditions and currency stability.

Bonds (Fixed Income): IOUs from governments or corporations. When you buy a Nigerian government bond, you’re lending money to the government in exchange for regular interest payments. However, when inflation exceeds bond yields, these “safe” investments actually lose purchasing power over time.

Cash Equivalents: Treasury bills, money market funds, savings accounts, and term deposits. These offer the highest safety and liquidity but often deliver negative real returns when inflation runs above deposit rates, a common scenario across Africa.

Traditional investments offer transparency and daily pricing, but they tend to move together during stress periods, offering less diversification than they appear to provide.

Alternative Investments: The Diversifiers

Private Markets: Private equity (owning pieces of companies not traded publicly), venture capital (investing in startups), and private credit (making loans to companies). These investments typically lock up your money for 5-10 years but can provide returns independent of public market movements.

Real Assets: Real estate, infrastructure projects, commodities (gold, oil, agricultural products), and farmland. These investments often provide natural hedges against inflation because their values tend to rise with the cost of living, crucial protection in high-inflation African economies.

Digital Assets: Cryptocurrencies and blockchain-based investments. While volatile and speculative, they offer exposure to technology trends and can provide currency diversification for African investors seeking hard currency exposure.

The common thread among alternatives: they respond to different economic forces than traditional investments, potentially providing portfolio stability when public markets struggle with currency devaluation or local economic shocks.

Key Differences That Actually Matter for African Investors

Return Drivers: Independent vs Connected

Traditional investments rise and fall with broad market sentiment and local economic conditions. When global investors reduce exposure to African markets, local stocks typically fall regardless of individual company performance. This pattern was evident in 2024, when African venture capital funding experienced a notable decline, with approximately $1.2 billion raised by the third quarter and projected full-year totals between $2.2 billion and $2.6 billion. This reduction primarily reflected a global pullback in capital rather than weaknesses in African business fundamentals.

Alternative investments respond to different drivers entirely. A private credit facility secured by commodity exports earns returns based on the borrower’s cash flow, not stock market volatility. Real estate generates rental income that often adjusts with inflation. Private equity values companies based on operational improvements rather than public market multiples.

This independence becomes crucial for managing risk and return in African portfolios. While developed market investors use alternatives for return enhancement, African investors often need them for return stabilization when local markets become too volatile or correlated.

Correlation and Portfolio Protection

During crisis periods, traditional assets often move together far more than their historical averages suggest. The COVID-19 crash revealed concerning patterns: African equities typically exhibit strong correlations with global markets, often rising substantially during periods of major currency or financial crises. Local bonds tend to have moderate correlations with local equities, with both correlations frequently climbing above 0.90 during times of market stress.

Quality alternatives break this pattern by providing non-correlated assets that perform independently of financial markets. Real assets like property and commodities often maintain value when currencies weaken. Private credit secured by hard assets can generate steady returns even when public markets struggle.

This matters more in African portfolios because local traditional assets are already highly correlated due to limited market depth and common exposure to currency and political risks.

Liquidity vs Returns: The Core Trade-off

Traditional assets offer immediate liquidity. You can sell blue-chip stocks, government bonds, or money market funds within minutes during market hours, critical flexibility when opportunities or emergencies arise.

Alternative assets lock up capital for extended periods. Private equity commitments typically run 7-10 years. Infrastructure investments may be illiquid for decades. Even “liquid” alternatives like REITs can face redemption restrictions during market stress.

This liquidity sacrifice typically comes with compensation through an “illiquidity premium” that historically averages 2-4% annually. For patient capital, this premium can significantly enhance long-term risk and return profiles.

Fees and Cost Considerations

Traditional investments have become increasingly commoditized. You can buy diversified equity ETFs for 0.1% annually or trade individual stocks for minimal brokerage fees. Government bonds trade with published yields and transparent pricing.

Alternative investments carry higher fees reflecting their complexity and active management. The standard “2 and 20” structure (2% management fee plus 20% of profits) means alternatives must meaningfully outperform to justify their cost.

Higher fees also mean less transparency. While you can check traditional portfolio values every minute, alternative investments typically provide valuations quarterly or annually.

Access Barriers and Minimums

Traditional investments have become extremely accessible. You can buy single shares of most stocks or start investing in mutual funds with as little as $100 in some African markets.

Alternative investments often require substantial minimum commitments- commonly around $10,000 for real estate funds, $50,000 or more for private equity, and $1 million or more for hedge funds, historically limiting access primarily to wealthy investors. However, by 2025, growing democratization through new fund structures and digital platforms is lowering these barriers, with some minimums now as low as $1,000 to $10,000, expanding access well beyond the ultra-wealthy. Additionally, technology-driven options like REITs, commodity ETFs, and crowdfunding platforms offer alternative-like exposure with lower minimums and greater liquidity

When to Choose Alternatives Over Traditional Investments

Currency Devaluation Periods: When local currencies weaken significantly, alternatives denominated in stable currencies provide natural hedging. During Nigeria’s naira devaluation in 2023, investors with USD-based real estate or commodities maintained purchasing power while local traditional assets lost value in global terms.

High Inflation Environments: Real assets like property, infrastructure, and commodities often adjust with or outpace inflation. With many African countries experiencing double-digit inflation, alternatives tied to hard assets offer protection that traditional fixed-income cannot provide.

Shallow Market Conditions: When local stock exchanges offer limited opportunities or become dominated by a few sectors, alternatives provide access to strategies unavailable through public markets.

Long-term Wealth Building: For investors with 10+ year horizons, alternatives’ illiquidity premiums and non-correlated assets benefits can significantly enhance portfolio performance.

When Traditional Investments Excel

Liquidity Needs Are Critical: If you might need capital within 1-3 years for known expenses or opportunities, traditional assets’ immediate liquidity becomes invaluable.

Building Foundational Wealth: Investors with portfolios under $25,000 often benefit more from low-cost traditional diversification than from paying high fees for limited alternative access.

Simplicity Requirements: Traditional assets have clearer tax treatment, transparent pricing, and simpler regulatory frameworks—especially important for diaspora investors managing cross-border complexities.

Market Efficiency Exists: In deep, efficient markets with stable currencies, traditional diversification can provide adequate risk and return profiles without alternative complexity.

African Investor Use Cases: When Context Changes Everything

Inflation and Currency Protection Strategies

Nigerian inflation reached 33.7% in April 2024 while savings accounts paid around 15%. Even government bonds yielding 19% delivered negative real returns. The Ghana cedi weakened over 50% against the dollar in 2022. These aren’t temporary disruptions, they represent structural challenges that make traditional allocation frameworks inadequate for African investors.

Local traditional assets often cannot protect purchasing power over time, particularly when adjusted for currency depreciation. Dollar-denominated alternatives like international real estate, commodity exposure, and private credit in stable currencies provide inflation and currency hedging that local traditional assets simply cannot offer consistently.

Market Depth and Access Constraints

Africa’s stock markets represent just 2% of global market capitalization despite the continent being 17% of the world’s population. To put this in perspective, this is smaller than many individual global technology companies. Building resilient portfolios using only local traditional assets becomes structurally difficult when entire continental markets lack the depth of diversified investment opportunities.

Alternatives provide access to sectors, geographies, and strategies unavailable through African public markets. Private equity can access growing African businesses before they go public. Real estate funds provide exposure to commercial properties across multiple countries. Commodity investments hedge against resource price cycles that often drive African economies.

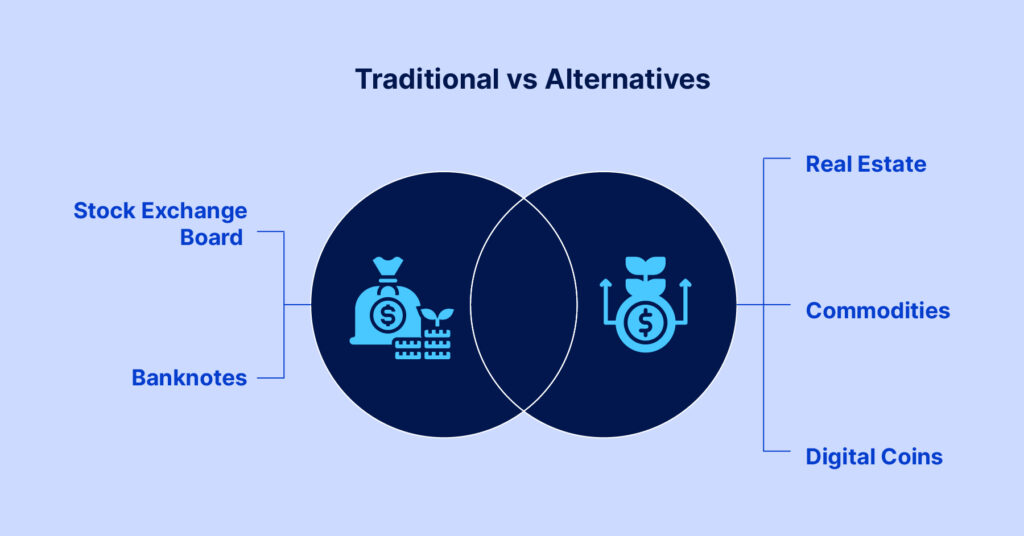

Alternative Investments vs Traditional Investments in Africa

| Feature | Traditional Investments | Alternative Investments |

| Liquidity | Daily (market hours) | Monthly to 10+ years |

| Minimum Investment | $100-1,000 | $10,000-1,000,000+ |

| Annual Fees | 0.1%-2% | 1%-3%+ |

| Transparency | Daily pricing, public info | Quarterly/annual reports |

| Market Correlation | High during crises | Lower correlation |

| Currency Exposure | Usually local currency | Often hard currency |

| Inflation Protection | Limited (especially bonds) | Often excellent (real assets) |

| Volatility Display | Visible daily | Hidden/smoothed |

| Tax Treatment | Generally straightforward | Often complex |

| Best Use Case | Foundation, liquidity needs | Diversification, patient capital |

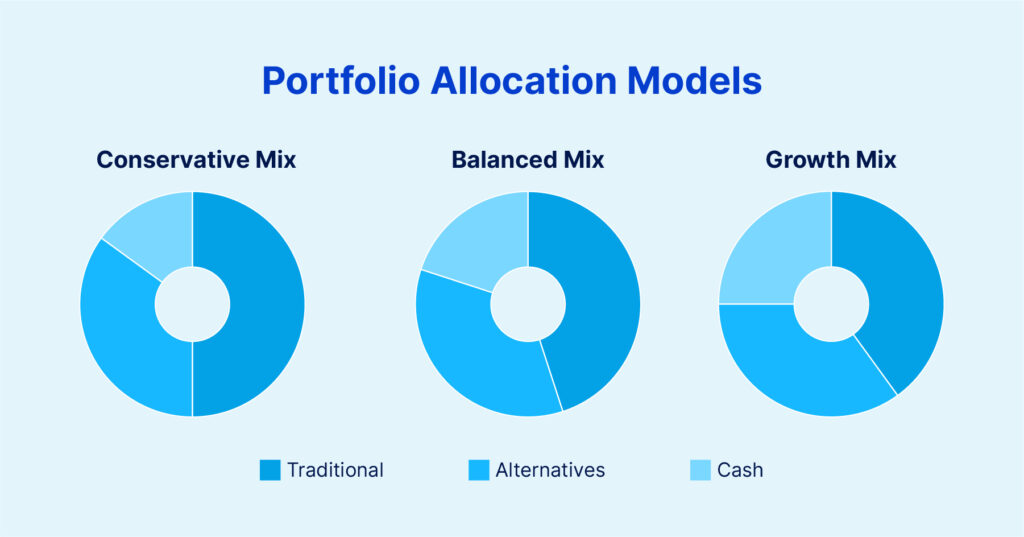

Building Blended Portfolios: Three Strategic Approaches

The optimal approach isn’t choosing alternative investments vs traditional investments Africa as an either/or decision. Successful African investors blend both based on their specific circumstances and goals.

Conservative Mix: Wealth Preservation Focus (Ages 50+)

Goal: Protect purchasing power with minimal volatility

- 50% Traditional: High-grade bonds (mix local/hard currency), dividend stocks

- 35% Liquid Alternatives: REITs, commodity ETFs, stable value funds

- 15% Cash Buffer: Emergency funds and opportunities

Best for: Pre-retirees, conservative investors, those needing capital within 5 years

Balanced Mix: Growth with Stability (Ages 30-50)

Goal: Build wealth while managing African-specific risks

- 45% Traditional: Growth stocks (local and international), government bonds

- 35% Core Alternatives: Real estate funds, commodity exposure, some private credit

- 20% Growth Alternatives: Private equity, infrastructure funds

Best for: Mid-career professionals, family wealth builders, 10+ year investment horizons

Growth Mix: Long-term Wealth Building (Ages 20-40)

Goal: Maximize long-term wealth despite higher volatility

- 40% Traditional: Growth equities, emerging market funds

- 35% Private Markets: Private equity, venture capital, private real estate

- 25% Real Assets: Direct property, commodity funds, infrastructure

Best for: High earners under 45, entrepreneurs, patient capital with 15+ year horizons

Portfolio Health Checklist

- Can you survive 12+ months without touching illiquid investments?

- Are you diversified across currencies (not over-concentrated locally)?

- Do you understand all fees and can justify them through performance?

- Are total annual fees under 2.5% across all holdings?

- Can you explain each major holding’s purpose in one sentence?

Wealth-Destroying Mistakes to Avoid

The “All Traditional” Trap

Keeping 100% in local stocks, bonds, and cash because they feel safer virtually guarantees wealth erosion when local currencies devalue and inflation exceeds traditional asset returns. Many African investors learned this lesson during recent currency crises.

The “All Alternative” Mistake

Allocating heavily to illiquid alternatives without maintaining adequate liquidity buffers. When opportunities or emergencies arise, these investors are forced to sell at unfavorable terms or miss opportunities entirely.

Currency Concentration Risk

Building portfolios entirely in local currency without hard currency exposure. This strategy only works if local currencies strengthen over time, a risky bet given African currency performance over the past decade.

Fee Blindness

Paying 3%+ annual fees for alternatives that deliver returns comparable to low-cost traditional portfolios. High fees must be justified by superior risk and return profiles or genuine diversification benefits.

Market Timing Attempts

Trying to switch between traditional and alternative allocations based on market predictions. Both asset classes serve different purposes and should be held consistently rather than traded tactically.

Your Essential Questions Answered

Are alternative investments riskier than traditional investments?

They carry different types of risk rather than necessarily higher risk and return profiles. Traditional investments show their volatility daily, you can watch your stock portfolio swing up and down. Alternatives hide their volatility through infrequent valuations but carry illiquidity risk, manager selection risk, and often concentration risk.

For African investors specifically, alternatives may actually reduce total portfolio risk by providing currency diversification and non-correlated assets benefits that local traditional assets cannot offer. The key is understanding what risks you’re trading off.

How much should a beginner allocate to alternatives?

Start with 10-15% of investible assets in liquid alternatives like REITs or commodity ETFs. These provide alternative-like benefits while maintaining reasonable liquidity and lower minimums. As your knowledge and capital grow beyond $25,000, consider increasing to 20-30% if your time horizon supports longer lockup periods.

The rule: never allocate more to illiquid alternatives than you can afford to lose access to for 5-7 years.

When should I choose alternatives over traditional investments?

Choose alternatives when you have:

- Investment horizons longer than 5 years

- Adequate liquidity in traditional assets

- Specific risks to hedge (currency, inflation, correlation)

- Access to quality alternative managers or platforms

- Portfolio size large enough to justify higher fees

Stick with traditional when you need liquidity within 3 years, have limited investment capital, or lack access to quality alternative investments.

How do I evaluate alternative investment opportunities?

Focus on three key areas:

- Track Record: Manager’s historical performance across full market cycles

- Strategy Fit: How the investment provides non-correlated assets exposure to complement your existing portfolio

- Terms: Fee structure, liquidity provisions, and minimum commitments

Avoid alternatives that you can’t understand clearly or that seem too good to be true.

The biggest risk for African investors isn’t taking risk, it’s maintaining portfolios that can’t handle structural challenges like currency volatility, inflation, and shallow local markets.

The path forward is to build portfolios where traditional assets provide liquidity and foundational returns while alternatives provide the diversification and protection that local markets cannot offer consistently.

Ready to build a more resilient portfolio that can handle African investment realities? The framework is clear, but implementation requires understanding your specific situation, risk tolerance, and access to quality investment opportunities.

This analysis is for educational purposes and does not constitute financial advice. Alternative investments involve risks including potential loss of principal, illiquidity, and concentration risk. Past performance does not guarantee future results. Currency values fluctuate and may affect returns. Consider consulting qualified financial advisors familiar with African market conditions before making investment decisions.