The semiconductor wars just got a government co-pilot, and the market isn’t subtle about picking winners.

Intel surged 23% not on earnings magic, but on whispers of federal backing. Meanwhile, companies with solid fundamentals got hammered for slowing growth rates. The message? Policy backing now matters as much as profit margins.

At Opportunik, we don’t just track price movements, we show you what they mean for your wealth strategy. Here’s what moved, why it happened, and what globally minded African investors should be positioning for:

Top Movers: Winners and Losers

Top 5 Gainers

| Ticker | Company | Weekly Change |

| INTC | Intel Corporation | +23.11% |

| BE | Beam Global | +23.04% |

| CAI | Caris Life Sciences | +22.69% |

| TKO | TKO Group Holdings | +15.65% |

| RDDT | +14.42% |

Intel (INTC): Here’s the week’s biggest story. Intel’s CEO went from potential resignation to potential government partnership in 72 hours. Mixed Q2 earnings? Nobody cared. Reports of federal equity stakes in Ohio manufacturing transformed Intel from struggling chipmaker to national champion. We’re witnessing policy-driven valuations that ignore traditional metrics entirely.

Beam Global (BE): Textbook market psychology at work. The sustainable infrastructure company ran 23% on anticipation, then gave back gains post-earnings despite 12% revenue growth. Sometimes the journey matters more than the destination.

Caris Life Sciences (CAI): The molecular profiling company missed EPS by 28% and still surged 23%. Why? Fresh IPO glow and a $722.7 million war chest matter more than quarterly perfection when you’re playing the long game.

TKO Group Holdings (TKO): That $7.7 billion UFC-Paramount+ deal isn’t just sports content, it’s revenue model evolution. Moving from pay-per-view to streaming subscriptions means predictable cash flows that institutional investors love.

Reddit (RDDT): The social media platform keeps proving that community-driven platforms can monetize effectively. 78% revenue growth and profitability aren’t accidents, they’re the result of understanding your audience.

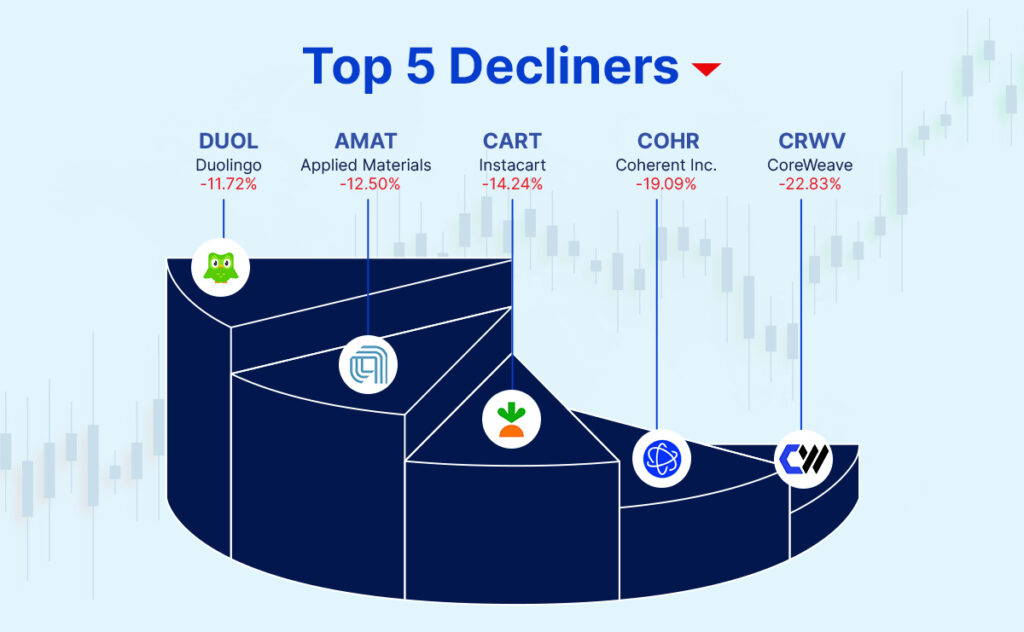

Top 5 Decliners

| Ticker | Company | Weekly Change |

| CRWV | CoreWeave | -22.83% |

| COHR | Coherent Inc. | -19.09% |

| CART | Instacart | -14.24% |

| AMAT | Applied Materials | -12.50% |

| DUOL | Duolingo | -11.72% |

CoreWeave (CRWV): When your IPO lock-up expires, brace for impact. CoreWeave learned this lesson the hard way as previously restricted shares flooded the market. Good operational news, trimmed losses and expanded capacity couldn’t overcome basic supply and demand economics.

Coherent (COHR): Sometimes beating earnings isn’t enough. Coherent’s strong Q4 results got overshadowed by BofA’s downgrade over slowing data center growth. In hot sectors like AI infrastructure, deceleration feels like decline to growth-hungry investors.

Applied Materials (AMAT): Record Q3 revenue couldn’t save the stock when management cited “capacity digestion in China” for weaker Q4 guidance. Forward-looking uncertainty trumps backward-looking success every time.

Equities to Watch

Consumer Resilience Testing

- WMT, TGT: Retail earnings reveal tariff policy impact on American consumer capacity

- HD: Housing market strength indicator amid economic uncertainty

- INTU: Small business health barometer through software adoption metrics

Technology Infrastructure

- PANW: Enterprise cybersecurity spending patterns signal IT budget health

- ADI, KEYS: Industrial semiconductor and R&D spending indicators

- WDAY: Enterprise software demand trends

Healthcare & Innovation

- MDT: Medical device market conditions

- XPEV: Chinese EV market dynamics and competitive positioning

Commodities & Currency Intelligence

Gold: Central Bank Accumulation Continues

Gold targeting record annual averages as geopolitical uncertainty drives institutional safe-haven demand. African investors benefit from both wealth preservation and exposure to continental gold production.

Oil: Supply Forecast Divergence

IEA projects oversupply while OPEC anticipates tighter markets. Trump-Putin meetings could shift supply dynamics, impacting African oil-producing economies.

Dollar Dynamics

Federal Reserve’s “higher-for-longer” stance strengthens USD trajectories. Creates entry opportunities for African capital seeking U.S. assets at favorable exchange rates while pressuring local currency stability.

Currency Pairs to Monitor:

- USD: Fed policy driving strength

- EUR: Resilient on improving PMI data

- CNY: PBoC intervention maintaining stability

- JPY: Range-bound on BoJ policy consistency

Digital Assets: Institutional Adoption Signal

Ethereum’s Market Share Expansion ETH surged 52% monthly, capturing market share from Bitcoin as institutional capital recognizes programmable money infrastructure. BTC dominance declined to 59.87% from 66%, signaling sophisticated capital preference for utility over narrative.

Key Movements:

- Bitcoin (BTC): Momentum slowing as profits rotate to altcoins

- Ethereum (ETH): Record ETF inflows driving institutional adoption

- Cardano (ADA): Futures open interest hit $1.44 billion—institutional positioning signal

- Solana (SOL): Strong on-chain activity supporting ecosystem growth

Policy Tailwinds: Expected U.S. regulatory clarity creating institutional deployment conditions. African investors should position for continued digital asset infrastructure expansion.

ETFs to Watch

Technology Exposure:

- QQQ: Nasdaq 100 strength continues (11.4% YTD)

- VGT: Technology sector leadership (11.9% YTD)

Safe Haven Assets:

- GLD: Gold’s 24.3% YTD performance attracting institutional flows

- SLV: Silver’s 27.3% YTD gain on supply deficit fundamentals

Emerging Themes:

- BLOK: Blockchain infrastructure benefiting from regulatory clarity

Insights

1. Policy Premium Emerging Intel’s surge despite earnings weakness demonstrates that government backing now commands valuation multiples independent of traditional metrics. African companies aligned with national technology initiatives may experience similar policy-driven premiums.

2. Growth Quality Over Quantity Coherent’s decline despite earnings beats shows deceleration concerns override absolute performance in high-growth sectors. Sustained acceleration, not just growth, drives institutional confidence.

3. Liquidity Structure Impact CoreWeave’s lock-up expiration selling pressure proves equity design affects price discovery regardless of operational performance. African companies accessing capital markets must engineer thoughtful liquidity from inception.

What this Means for African Investors

Current market conditions favor African investors with patient capital and global perspective.Global markets are experiencing fundamental shifts as policy intervention reshapes traditional valuation frameworks. Alternative assets and technology infrastructure are creating new wealth-building pathways that transcend geographic boundaries.

Opportunik provides exclusive access to these evolving opportunities through institutional-grade analysis and alternative investment solutions designed for African capital building generational wealth.

Diversify your Portfolio with Alternative Assets

Looking beyond public markets? Speak to an Opportunik Advisor to structure your alternative investment portfolio and position for the next phase of global wealth creation.

Speak with an Opportunik advisor today to explore alternative investment opportunities tailored to your financial future.