In a world where wealth moves freely, global investment for Africans is no longer optional, it’s essential.

For many Africans, whether based on the continent or part of the global diaspora, investing internationally can feel inaccessible. Like something reserved for the elite few with Wall Street contacts or second passports.

But that’s no longer true.

Today, Africans are not just participating in global capital markets. They’re helping shape them.

This article explores what it means to invest globally as an African, why it matters, and how to get started with structure and confidence.

Why Global Investing Should Matter to Africans

Wealth creation on the continent has long been constrained by local conditions, shallow capital markets, volatile currencies, and limited access to institutional-grade opportunities.

Looking beyond borders allows African investors to:

- Diversify risk by reducing exposure to domestic shocks, currency devaluation, and political instability

- Access stronger returns through high-performing sectors and more stable economies

- Preserve wealth, especially for diaspora investors earning in hard currency

- Build legacy through globally diversified portfolios that endure across generations

This isn’t about turning away from African markets. It’s about using global leverage to strengthen African capital.

Who is the Global African Investor?

From tech founders in Nairobi to oil professionals in Houston, the modern African investor is:

- Globally mobile, living, working, or earning across borders

- Digitally enabled, using fintech to access previously exclusive markets

- Legacy-minded, building for the next generation- not just the next paycheck

Whether you’re mid-career in Toronto or second-generation in London, access to global investment platforms has become easier, faster, and more transparent. Platforms such as Opportunik Global Fund are making it easier for Africans to invest in global markets, preserve wealth, and build structured portfolios.

The Real Barriers and How to Navigate Them

If global investing makes sense, why aren’t more Africans doing it?

Some of the most common barriers include:

- Limited knowledge about global financial instruments

- Regulatory concerns or fear of compliance risks

- Mistrust of unfamiliar platforms or custodians

But these obstacles are increasingly manageable:

- Start small but structured by using licensed platforms tailored to African investors

- Engage professional advisors who understand both your goals and your location

- Prioritize transparency and liquidity, especially for your first international investments

Education and access are improving. What’s needed now is intentionality.

What to Invest in: Asset Classes for the African Global Investor

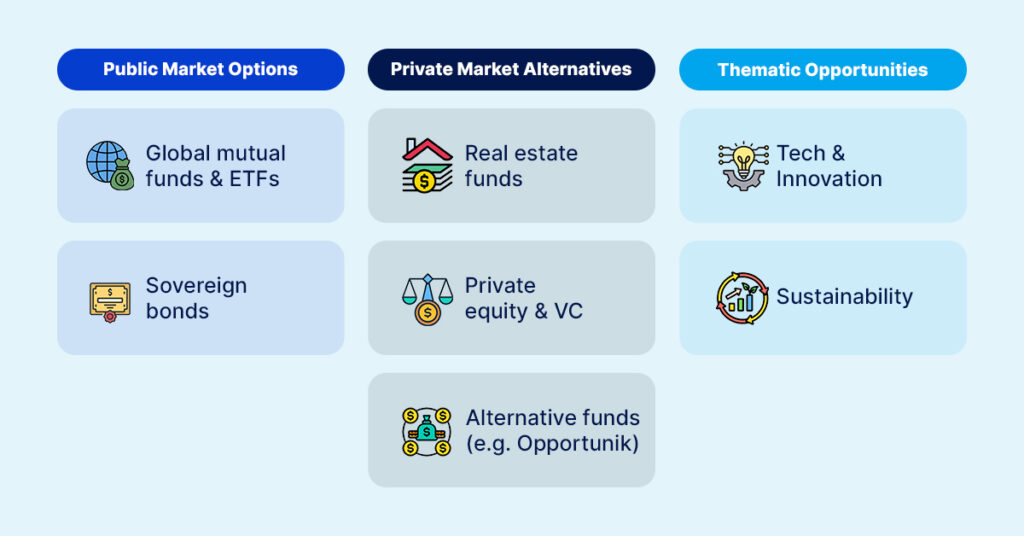

Investing globally doesn’t just mean buying Apple or Tesla stock. Consider a diversified mix of asset classes:

Public Market Options

- Global mutual funds and ETFs offer low-cost diversification and exposure to multiple geographies

- Government bonds, especially dollar-denominated sovereign bonds from stable economies

Private Market Alternatives

- Real estate from commercial property funds in Europe to residential REITs in the U.S.

- Private equity and venture capital, ideal for investors with longer horizons

- Alternative funds such as Opportunik Global Fund, which curates regulated, dollar-based investment opportunities specifically for African investors

Thematic Opportunities

- Technology and innovation, especially appealing to diaspora investors familiar with global brands and digital platforms

The key is balance between risk and return, between public and private assets, and between long-term vision and near-term liquidity. However, structure is the difference.

Wealth isn’t built by accident. It’s built by design.

A global portfolio should reflect:

- Your risk tolerance: conservative, moderate, or growth-oriented

- Your financial goals: education, retirement, business capital, or legacy planning

- Your time horizon: short-term safety versus long-term growth

Don’t chase trends or rely on tips. Build a disciplined investment strategy that aligns with your life, your income, and your ambitions.

This is Bigger than Access. It’s About Influence.

Africans are not just participants in global financial flows. They’re becoming catalysts.

Consider the numbers:

- Diaspora remittances exceed $50 billion annually

- Africa’s middle class is one of the fastest-growing in the world

- Institutional investors are increasing their exposure to African growth markets

But capital without coordination is capital without influence.

By investing globally and strategically, Africans can move from the periphery to the core of the financial system, shaping how capital flows, where it goes, and whom it serves.

Here is how to start investing globally

- Assess your financial position: understand your net worth, liquidity needs, and income stability

- Clarify your investment goals: are you investing for passive income, capital growth, or future legacy?

- Choose the right platform: look for transparency, regulatory compliance, and ease of use

- Start with what you understand: familiarity helps you stay the course

- Review and rebalance regularly: your goals and the markets will evolve, your portfolio should too

Platforms like Opportunik Global Fund are tailored to guide Africans through this journey, combining access with structure.

Your Capital Deserves a Global Stage

If you earn in hard currency but only invest locally, for instance, you’re limiting your capital’s potential.

Whether you’re in Johannesburg, Kigali, London, or Atlanta, your capital should be working across borders and across generations.

Wealth isn’t about what you earn. It’s about what you keep, what you grow, and where you grow it.

Finally, build globally, build intentionally and explore global alternatives with Opportunik Global Fund. Book a session here